IJCRR - 8(6), March, 2016

Pages: 35-39

Print Article

Download XML Download PDF

HEALTH INSURANCE COVERAGE : A CROSS-SECTIONAL STUDY AMONG PATIENTS FOLLOWED AT THE DIABETES CENTRE OF ABIDJAN COTE D'IVOIRE (CADA)

Author: Kadidiatou Raissa KOUROUMA, Apollinaire YAPI, Felix Kouame ACKA

Category: Healthcare

Abstract:Objective: This study aimed to evaluate the extent and types of health insurance coverage in a representative sample of adults with diabetes. Methods: This descriptive cross-sectional study was performed from May 6, 2015 till July 1, 2015 in the Diabetes Centre of Abidjan, with a sample of 500 diabetic patients followed for more than one year. Data was analyzed using SPSS version 18. Results: A total of 76.8% of all adults with diabetes had no form of health insurance. The main reason was the lack of financial resources (65.2%). Of the insured diabetic patients (23.2%), 51.7% were covered only by Civil Servants and State Workers of Côte d'Ivoire Fund, 20.7% had only a private for profit health insurance and 5.2% were covered through community based health insurance. Besides, 22.4% of responding patients had a private for-profit health insurance to supplement their Civil Servants and State Workers of Côte d'Ivoire Fund coverage. The fact to have a health insurance was influenced by age, gender, the level of education, employment sector and monthly income (p< 0.0001). Conclusion: Our findings show of the necessity to develop health policy to improve access to coverage for patients suffering from chronic disease such as diabetes, notably through Universal Health Coverage.

Keywords: Health insurance, Diabetes, Healthcare financing, Health system, Cote d’Ivoire

Full Text:

INTRODUCTION Health financing mechanism was developed to counteract the detrimental effects of user fees introduced in the 1980s, which now appears to inhibit heath care utilization, particularly for marginalized populations, and to sometimes lead to catastrophic health expenditures1 . In sub-Saharan Africa, the cost of health is often taken over by individuals; public contributions and health insurance companies hardly covering 10 to 15 % of the population2 . In Cote d’Ivoire, according to the World Health Organization’s Global Health Observatory, the total health spending was $172 per capita in 20133 . Of this, 69 % was paid out-ofpocket by households, while 27 % was funded by the government. In fact, in Côte d’Ivoire, household payments as a percentage of total health spending have long been among the highest in the West African Economic and Monetary Union (WAEMU)4 .

To improve healthcare utilization and to protect households against impoverishment from out-of-pocket expenditures, health insurance appears as a promising means, since it is attracting more and more attention in low and middle-income countries 5,6 In Cote d’Ivoire the main health insurance organizations are nonprofit groups including: Civil Servants and State Workers of Côte d’Ivoire Fund (MUGEFCI), National Social Security Fund for private sector employees (CNPS), Military Social Security Fund (Fonds de Prévoyance Militaire, FPM), National Police Social Security Fund (Fonds de Prévoyance de la Police Nationale, FPPN); Community-Based Health Insurance (CBHI)4 . Besides the nonprofit health insurance organizations, there are also private for-profit health insurance organizations (PPHI)4 . However, very few people (3-4% of the total population) in Côte d’Ivoire have health insurance7 .

The lack of health insurance coverage is often a barrier to receive routine, preventive medical care, yet these services are essential for people with diabetes who need regular checkups to monitor metabolic control, diabetes complications, and disease progression8 . Indeed, chronically ill patients such as diabetic patients often experience difficulty, paying for their medications9 . In Cote d’Ivoire where the prevalence of Diabetes is around 4.95% according to the International Federation of Diabetes (IFD), the cost of diabetes for the society in 2013 was around $162.4 compared to France where the cost was around $5,600.22 ; showing that an important part is supported by the patient.

Health insurance coverage is an important health policy issue in diabetes care, but very few studies in Cote d’Ivoire have examined the proportion of diabetic patients insured, the types of health insurance, or the reasons for not having health insurance among people with diabetes. Thus, in a context of progress towards Universal Health Coverage (UHC), this study aimed to explore theses issues among diabetic patients followed at the Diabetes Centre of Abidjan (CADA).

MATERIAL AND METHODS This is a descriptive cross-sectional study carried out in CADA, a healthcare service of the National Public Health Institute of Cote d’Ivoire. CADA is an outpatient clinic specialized in diabetes treatment, research, training and public awareness. The sample size was composed of 500 ambulatory diabetic patients followed regularly at CADA for more than one year, and chosen at random. Women with gestational diabetes were not included in the sample. Data was collected from May 6th 2015 until July 1st 2015, by the mean of a questionnaire with closed and opened questions.

The questionnaire was designed, based on a review of the literature and revised after a pilot testing with 30 diabetic patients. The first section of the questionnaire collected information about socioeconomic and demographic characteristics, information on medical history. The second section concerned health insurance status. If uninsured, diabetic patients should report reasons for not having health insurance. All the collected data were entered into SPSS 18.0. Descriptive statistics were used to describe the participant charac teristics, to show health insurance coverage, types of health insurance, and reasons for no health insurance coverage among uninsured people. Pearson’s chi-square was used to determine whether age, gender, level of education, monthly income, employment sector and complications of diabetes are related to health insurance status (p< 0.05 was considered as significant). The respondents signed the Informed Consent Form and their anonymity was preserved in the study. The study was approved by Research Ethics Committee and the National Public Health Institute of Cote d’Ivoire.

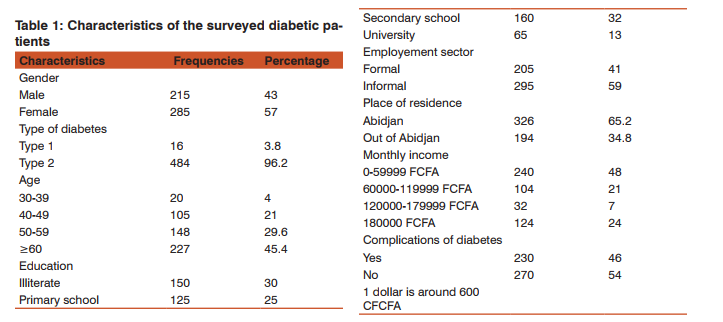

RESULTS Characteristics of the respondents (n=500) A total of 500 diabetic patients participated in this study; the characteristics of the responding patients are summarized in Table 1. The sample was in majority composed of women (57 %), and patients aged 60 and over (45.4%). Regarding economic characteristics of the patients, 59% worked in informal employment sector and 48% had a monthly income below the minimum inter professional guarantee salary wage (SMIG).

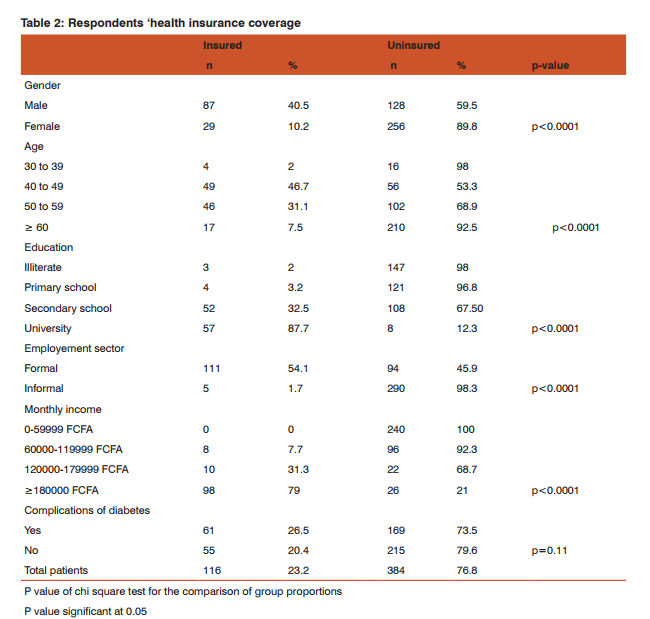

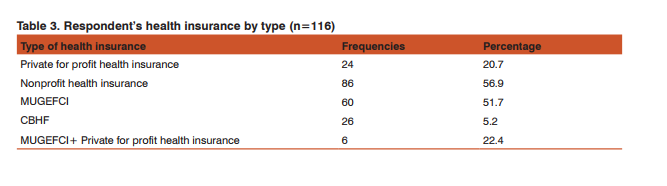

Health insurance status (n=500) The results showed that the majority of the diabetic patients (76.8%) had no health insurance. Chi-square of Pearson showed a highly significant correlation between gender, age, level of education, employment sector, monthly income and health insurance status; with p values less than 10-4. No difference (p=0.11) was found between those who had complications of diabetes and those who had not in terms of health insurance status (Table 2). Type of health insurance (n=116) Regarding the type of health insurance, the majority of the insured patients (51.7%) were covered only by MUGEFCI, 20.7% had only a PPHI and 5.2% were covered by CBHI.

In addition, 22.4% of responding patients also had PPHI to supplement their MUGEFCI coverage (Table 3) Reason for not having health insurance (n=384) Diabetic patients, who were not covered by health insurance, were asked about the reasons for not having health insurance. The results showed that the main reason was the lack of financial resources (65.2%), followed by the lack of confidence in health insurance systems (18.7%) and the lack of knowledge concerning the functioning of health insurance (16.1%). The uninsured diabetic patients turned to relatives to pay for the treatment in 54% of the cases or paid themselves in 46% of the cases.

DISCUSSION Health insurance coverage faces several challenges in Cote d’Ivoire notably the protection of people living with diabetes against the expenditures of medical care; this challenge remaining more important as regards indigent diabetic patients. Our findings showed that 76.8 % of diabetic patients followed at CADA had no form of health insurance and 23.2% was insured. These results are far from those obtained in a study performed in Burkina Faso in a sample of 388 diabetic patients, where only 1.5% of them had health insurance10. As regards the insured patients, 51.7% was covered by MUGEFCI.

Besides, 22.4% of the respondents stated to have PPHI to supplement their MUGEFCI coverage. This recourse to PPHI can be explained by the limits of government to finance care; it is also to be expected that demands unsatisfied in the public sector will be expressed as private payment, which might be more efficient than public mechanism11. Moreover, despite the implication of CBHI in the protection of poor household and workers of informal sectors against catastrophic expenditures12, only 5.2% was covered by CBHI. It is important for the Ivoirian government in a context of progress towards the UHC, to extend risk health coverage by the promotion of CBHI and sensitization of individual of working in the informal sector and living in rural area. Our study noticed that gender, age, level of education, employment sector and monthly income influenced health insurance status. Among the insurant diabetic patients, men, patients aged 40-59, patients with at least a secondary school level, diabetic patients working in formal employment sector and diabetic patients with a monthly income above 180000 FCFA ($300) are more numerous (p<0.0001).

As regards education, according to Dubois, people who received a formal education would give greater attention to health risks, would be more opened to innovation and have larger intellectual abilities to understand the interests of the mutual healthcare insurance system13. However, a study conducted in Senegal highlighted that health insurance status is not influenced by age, gender and complications of diabetes. This last variable would have been able to be a favoring factor12. Concerning the reasons for not having health insurance, 65.2% of the participants cited the lack of financial resources as the main reason. Indeed, the lack of financial resources is often the first reason mentioned by insured and uninsured to explain the low participation in mutual health13,14,15,16. However, the phenomenon of low insurance in developing is multifaceted. Substantial evidence suggests that negative attitudes toward the idea of health insurance have their roots in financial, cultural, traditional, religious, cognitive, experiential, psychological and other grounds17. Additionally, our findings revealed that the uninsured diabetic patients paid themselves for their treatment in 46% of the cases, or they turned to a relative or the religious community in 54% of the cases. Kyelem CG et al, also highlighted the financial support provided by the relatives of diabetic patients10. Indeed in their study, a total of 155 diabetic patients declared to benefit from the financial support of their family in 97.4% of the cases and of a friend or a donor in 2.6% of the cases10.

Another study in Cameroun, reported that the global care of diabetes is supported at 73% by the patient himself18. The effects of diabetes on the individual have repercussions on the whole family, even community. A study found that 15% of the members of the concerned families had stopped working to take care of a relative suffering from diabetes and that 20% had had to reduce their hourly working19. As Cote d’Ivoire is moving towards UHC, the results of our study will help health policy makers to adopt a national strategy to ensure that diabetic patients have coverage for routine care and protect them against expenditures of medical care.

Given the fact that half of the diabetic patients are working in the informal sector and earn less than 60000FCFA ($100), the minimum inter professional guarantee salary wage, it would be interesting to organize this sector into community based health found. Our study has a few limitations. It is cross-sectional study; hence it captures only a single point in time. Besides, this study was conducted in a single Diabetes Centre; therefore the results obtained might not be generalized to all the diabetic patients living in Cote d’Ivoire.

CONCLUSION Health insurance is an important matter for diabetic patients. Our study shows the need to implement adequate and affordable health insurance in order to help diabetic patients to access the supplies, medications and healthcare. The Ivorian government should develop health policies to improve access to coverage for diabetic patients, notably by the mean of Universal Health Coverage.

Conflits of Interests: none

ACKNOWLEDGEMENTS The authors would like to thank all of the participants who volunteered their time to participate in the study. Authors acknowledge the immense help received from the scholars whose articles are cited and included in references of this manuscript. The authors are also grateful to authors / editors / publishers of all those articles, journals and books from where the literature for this article has been reviewed and discussed.

References:

1. Mcintyre D, Thiede M, Dahlgren G, et al. What are the economic consequences for households of illness and of paying for health care in low-and middle-income country contexts?.Social science and medicine, 2006; 62(4):858-865.

2. International Diabetes Federation (IFD). IDF Diabetes Atlas, Sixth edition. Brussels, Belgium : International Diabetes Federation; 2013. Available from www.idf.org/sites:default/EN_6E_ Atlas_Full_0.pdf

3. World Health Organization Global Health Observatory. Available from http://www.who.int/countries/civ/en/

4. Juillet A, Konan C, Hatt L et al. Measuring and Monitoring Progress Toward Universal Health Coverage: A Case Study in Côte d’Ivoire. Bethesda, MD: Health Finance and Governance Project, Abt Associates.2014.

5. World health report 2010- Health systems financing: the path to universal coverage. Geneva: World Health Organization; 2010.

6. Spaan E, Mathijssen J, Tromp N et al. The impact of health insurance in Africa and Asia: a systematic review. Bull World Health Organ 2012;90:685–692A | doi:10.2471/BLT.12.102301

7. Institut National de la Statistique et ICF International. Enquête Démographique et de Santé et à Indicateurs Multiples de Côte d’Ivoire 2011-2012. Calverton, Maryland, USA: INS et ICF International 2012.

8. Casagrande SS, and Catherine CC. Health insurance coverage among people with and without diabetes in the US adult population. Diabetes care; 2012; 35(11): 2243-2249.

9. Piette JD, Wagner TH., Potter MB and Schillinger D. Health insurance status, cost-related medication underuse, and outcomes among diabetes patients in three systems of care. Medical care 2004;42(2):102-109.

10. Kyelem CG., Yaméogo TM., Ouédraogo MS et al. Caracté- ristiques thérapeutiques des diabétiques suivis au CHU de Bobo-Dioulasso, Burkina Faso. Health Sciences and Disease, 2014;15(2).

11. Pauly MV, Zweifel P, Sheffler RM et al. “Private health insurance in developing countries. Health Affairs, 2006; 25(2): 369- 379.

12. Jütting JP. “Do community-based health insurance schemes improve poor people’s access to health care? Evidence from rural Senegal. World development, 2004;(32)2: 273-288.

13. Dubois F. «Les déterminants de la participation aux mutuelles de santé: étude appliquée à la mutuelle Leeré Laafi Bolem de Zabré.» Mémoire de fin d’études, Université de Liège, DES en Gestion du Développement, 2002.

14. Harris MI. “Racial and ethnic differences in health insurance coverage for adults with diabetes. Diabetes Care, 1999; 22(10): 1679-1682.

15. DE Allegri M., Kouyante B., Becker H.et al. Understanding enrolment in community health insurance in sub-Saharan Africa: a population-based case-control study in rural Burkina Faso. Bulletin World Health Organisation, 2006;84(11): 852-858.

16. Durairaj V, D’Almeida S and Kirigia, J. Obstacles in the process of establishing a sustainable National Health Insurance Scheme: Insights from Ghana. Geneva, Switzerland: World Health Organization. 2010.

17. Kalenscher T. Attitude Toward Health Insurance in Developing Countries From a Decision-Making Perspective. Journal of Neuroscience, Psychology, and Economics, 2014; 7(3):174–193 http://dx.doi.org/10.1037/npe0000024

18. Ngassam E, Nguewa JL, Ongnessek S, et al. Coût de la prise en charge du diabète de type 2 à l’hôpital central de Yaoundé. Diabetes Metab 2012;38(Special issue 2):A105 [Abstract P318].

19. Betz Brown J, Gagliardino JJ and Ramaiya K. For International Diabetes Federation. Studies on the economic and social impact of diabetes in low- and middle-income countries. Presentation to IDF World Diabetes Congress. Montreal, October 2009. Available from http://www.idf.org/webdata/docs/WDC-PC-IDF%20Impact%20Studies.pdf

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License