IJCRR - 4(17), September, 2012

Pages: 31-46

Date of Publication: 14-Sep-2012

Print Article

Download XML Download PDF

TESTING INDEX VOLATILITY OF INDIAN STOCK MARKET IN THE CONTEXT OF FOREIGN INSTITUTIONAL INVESTOR\"S INVESTMENT

Author: Himanshu Barot, Dr. V.K.Sapovadia

Category: General Sciences

Abstract:Indian stock market has seen an unprecedented growth in the last few years. Since year 2002, Indian market has grown from a much volatile conditions to growth phenomena; this has been due to not only

the domestic market but also the international investors. FIIs investment is considered to be one of the key influencing factors after the economic fundamentals. From 1993 reforms in the Indian Capital market on liberalisation of the FII flows has a considerable impact on Indian stock market. The main objective of the study is to test index volatility of Indian stock market in the contest of FII?s net investment in equity and for this two net change in indices have been considered i.e. BSE Sensex and SandP CNX Nifty on annual basis from January 2000 to December 2011. The empirical result found through statistical tests like correlation, regression and t-test which reveals that significant relation between all three variables and result found that 2008 and 2011 were one of the worst years for Indian markets which make it the worst performer in Asia. Global financial recession in 2007 and slowing growth, rising inflation, and policy paralysis have blown the Indian markets off course in 2011. In 2008, the sub-prime crisis and Lehman brothers collapse crippled the global markets when 2011 saw high inflation rate dampening the market spirit. The Great Indian Dream seems to be coming to a close as most of the FIIs are pulling out of Indian markets. The FIIs were net sellers in year 2008 and 2011, pulling out their positions form the Indian market which leads to conclude that the FII is one of the key movers on volatility of Indian stock market and FII?s investment is not negligible for Indian Capital Market.

Keywords: FII, Index, volatility, BSE Sensex, S&P CNX Nifty, Inflation

Full Text:

1.INTRODUCTION

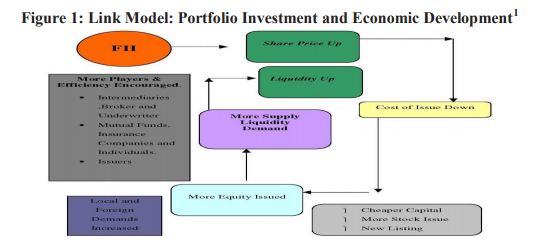

A well-developed stock market has its impact on the development of economy. It provides investors with an array of assets with varying degree of risk, return and liquidity. This increased choice of assets and the existence of a vibrant stock market provide savers with more liquidity and options, thereby inducing more savings. Increased competition from foreign financial institutions also paves the way for the derivatives? market. All this, according to the mainstream belief, encourages more savings in equity related instruments. This, in turn, raises the domestic savings rate and improves capital formation.

Above model indicating that portfolio investment is also a stimulus of economic development because, it?s a main source of fund of corporate. The demand of portfolio investment is created by companies and their routes are decided by government. It is considered as less reliable source of fund for economic development because it fluctuates on some minor trends of economy.

2 Foreign Institutional Investors

FII or the Foreign Institutional Investors are basically referred to investors who are organized in the form of an institution or entity and indulge in investing funds in the financial market of a foreign country, i.e. different from where the entity was originally registered or incorporated. In India, FII can invest their funds in the country only under the norms prescribed by Security and Exchange Board of India (SEBI). FII?s investment includes mutual funds, investment trust, asset management company, nominee company, bank, university funds, endowments, foundations, charitable trusts, charitable societies, overseas pension funds etc. It was in July 1991 that the New Economic Policy was unveiled that ushered in an era of Liberalization Privatization and Globalization (LPG) for the Indian economy. In September 1992 and 1993, India opened its stock market for foreign investors, which facilitated receipt of funds from foreign institutional investors in the form of equities. The enactment led to sweeping changes where various restrictions imposed on investments by the foreign investors in India were eased. SEBI opened a new path for the foreigners to invest in India by simplifying many terms and conditions due to which a large number of foreign investors flocked towards India.

2.1 Number of Foreign Institutional Investors (FIIs)

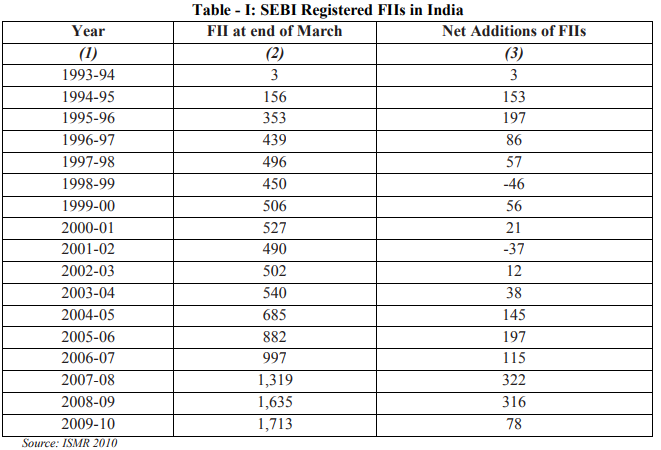

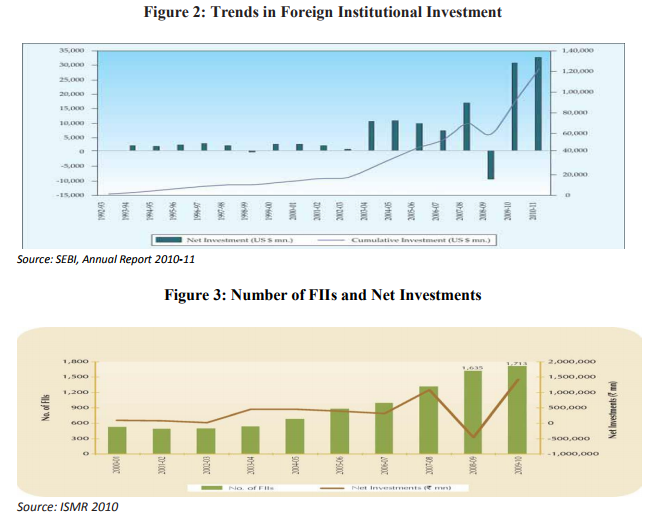

One of the most important features of the development of stock market in India in the last 20 years has been the growing participation of FIIs. Since September, 1992 when FIIs were allowed to invest in India, the no. of FIIs has grown over a period of time. The net addition in SEBI registered FIIs failed to keep up the momentum seen in 2007-08 and 2008-09 wherein there was addition of 322 and 316 FIIs respectively. There was a net addition of 78 SEBI registered FIIs in 2009-10 which took their total number to 1,713 at end March 2010 compared to that of 1,635 at the end of March 2009 (Table I and Chart II).

2.2 Trends in Investment of Foreign

Institutional Investors

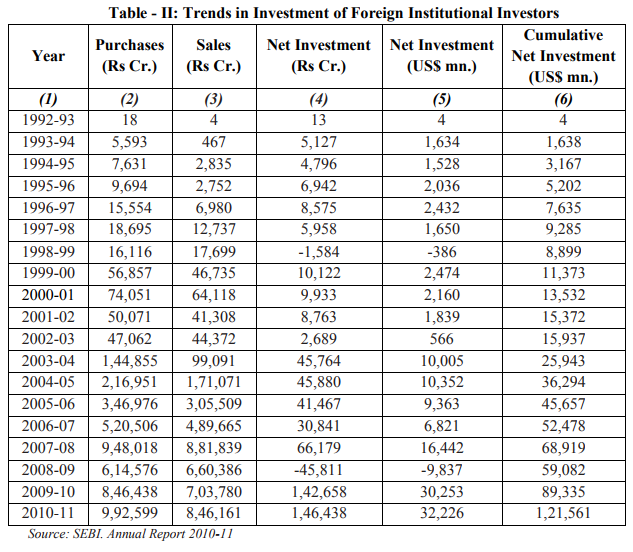

This is not unusual as most of the developing economies might be experiencing the same patterns. The increasing role of FIIs has brought in the development of our stock markets as well such as expansion of the business in securities, increased depth and breadth of the market, etc. FIIs contribute to almost 13% of the entire market capitalization at National Stock Exchange in India. If we talk of FIIs investment, this has been continuously grown over years except 1998-99 and 2008-09 when FIIs sold more than they purchased in Indian stock market. (Table II) The gross purchases of debt and equity by FIIs increased by 17.27 percent to Rs. 9,92,599 crore in 2010-11 from Rs. 8,46,438 crore in 2009-10 (Table II). The combined gross sales by FIIs increased by 20.23 percent Rs. 8,46,161 crore from Rs. 7,03,780 crore during the same period in previous year. The total net inflow of FII was increased by 2.65 percent Rs. 1,46,438 crore in 2010-11 as against an inflow of FII was Rs. 1,42,658 crore in 2009-10. This was the highest net inflow for any financial year so far.

Cumulative investment by FIIs at acquisition cost, which was USD 89.3 billion at the end of March 2010, increased to USD 121.5 billion at the end of March 2011 (Figure 2). Because of their war chests of money, the role of FIIs can?t be ignored. FIIs have dynamic portfolios across countries which they use to restructure and rebalance depending on the market conditions, definitely, with a motive to increase their gains. Because of their size of investment in any market, they have the ability to make or break the fortunes of any market.

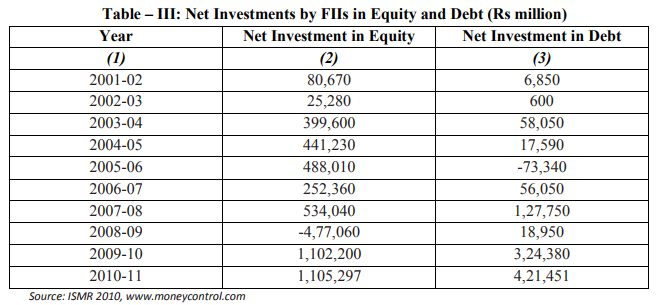

2.3 Foreign Institutional Investments- Equity and Debt

FIIs were allowed to invest in the Indian Capital Market from September 1992. Investments by them, however, were first made in January 1993. Till December 1998, investments were related to equity only as the Indian gilts market opened up for FII investment in April 1998. FIIs? investment in debt started from January 1999. Foreign Institutional Investors (FIIs) continued to invest large funds in the Indian securities market. For two consecutive years in 2004-05 and 2005-06, net investment in equity showed year-on-year increase of 10%.

After experiencing a net outflow of Rs 477,070 million in equity instruments in 2008-09, FIIs scaled record equity investment in 2010-11 which stood at Rs 1,105,297 million. (Table III) The net investments by FIIs in the debt segment also bounced back in 2010-11 with a staggering all-time high of Rs 421,451 million compared to that of Rs 18,950 and Rs 324,380 in 2008-09 and 2009-10 respectively.

3 Review of Literature

Many empirical studies have been conducted to examine the relationship between stock prices and buying of equity by FIIs in Indian stock market. Purnendra Verma (2001)2 studied the impact of FII on Indian Capital Market from 1993 to 2001 and found that there is significant effect of FIIs on Nifty and no significant effect on BSE Sensex, but in both the cases the co-efficient of correlation is low and very low so the effect are less and very less respectively. Study concluded that FII did not have any significant impact on the Indian Capital Market. T. N. Aravind, et al. (2008)3 examined the study on FII?s influence on Indian stock market for the period of 2003 to 2008 and concluded that in Oct. 2007, speculation about governments plan to control P-Notes had caused the biggest fall in Indian stock market. And they have proved that there is a direct relationship between the FII?s money flow and the movement of Sensex. Prasanna P.K. (2008)4 examined the contribution of FIIs in SENSEX base companies for the period of 2001 to 2006 and found that foreign investors invested more in companies with a higher volume of shares owned by the general public. The promoters? holdings and the foreign investments are inversely related. Study argued that the foreign institutional investors withdraw their money when the stock market performance starts slowing down. Dr. Rahul Singh, et al. (2008)5 studied of FIIs investment flow and SENSEX movement for period from January, 2004 to December, 2007 and proved with empirically that there is a negative correlation between the net FIIs and volatility in SENSEX. And with respect to net FIIs inflows and returns on SENSEX have a positive and significant correlation. Soumita Patra, et al. (2009)6 conducted the study on impact of FIIs flow on the BSE SENSEX and Nifty between 1997 and 2008 and proved that there is no significant relationship between FII and SENSEX excluding years 2003 and 2004 where FII and Nifty there is no significant relation. Gaurav Agrawal, et al. (2010)7 investigated the causal relationship between Nifty and FIIs net investment for the period January, 1999 to February, 2009 using daily data and through application of correlation test, found that Nifty is positively correlated to FIIs. Madan Sabnavis, et al. (2010)8 analyzed implications of FIIs inflow in Economic Studies from January to September 2010 and empirically proved that the coefficient of correlation is quite strong between FIIs flows and SENSEX movement which means there is a significant relationship. A.Q.Khan and Sana Ikram (2010)9 tested the efficiency in relation to the impact of FIIs largely on the Indian Capital Market during the period 2000 to 2010 and proved that there is a significant relation between the movement of FII and the two major stock exchanges of India that is the BSE and NSE. However the coefficient of correlation is a low degree of positive correlation indicating that the effect is not very strong. The study concluded that the FIIs investment has a significant impact on Indian Capital Market and the Indian Capital Market is Semi-strong form efficient in relation to the impact of FIIs investment on Indian Capital Market. Narendra Singh Bohra and Akash Dutt (2011)10 studied data from 2000 to 2009 and found that there is a positive correlation between stock market and investment of FII?s in a relation that Sensex follows the investment behavior of FII?s and in the case of individual group securities FII?s had shown a positive correlation in less regulated and high capitalized securities in the market to earn high equity yield. And study suggest to the policy implication that the authorities can focus on domestic economic policies to stabilize the stock market. M. Anuradha Reddy (2011)11 examined the FIIs investment behavior and its relationship between SENSEX movement during years 2000 to 2011 (May, 31) and found that the FIIs are influencing the Sensex movement and proved evidently there is a significant relation between FIIs flow and Sensex movement. Ravi Akula (2011)12 conducted the study on trends in foreign institutional investment in India for the period of 2006 to 2010, and observed that the FIIs investment has shown significant improvement in the liquidity of stock prices of both BSE and NSE. Study argued that there is a high degree of positive co-efficient of correlation between FIIs investment and market capitalisation which reveals that the liquidity and volatility in indices are highly influenced by FIIs flows. Dr. Ambuj Gupta (2011)13 examined the relationship between Indian Stock Market and FIIs investment in India for the period from April 2006 to February, 2011 and proved through tests that there is a positive relationship between stock market and FIIs investment which means when FIIs purchase/sell, there is an influence on the stock market. Consequently, either the stock market rise or fall on account of FIIs activities.

4 Statement of Problem

The growing participation of FIIs in Indian stock market has raised eyebrows of many Indians. Their influence on stock markets in India has been widely debated and remained a hot topic in media. Some of the market pundits believe that FIIs are responsible for rise or fall in the Indian stock market. This raises a question as to whether FIIs are really a cause or effect of the rise or fall in the Indian stock market. In this paper the Researchers make an earnest attempt to study the relationship between FII?s Investment and Indian Stock Market. For the purpose, two major stock indices viz. NSE and BSE have been selected. There are certain other significant factors also, which influence Stock market like inflation, government policies, budgets, economic factors etc. However, in this paper only one independent variable i.e. FII?s investment has been taken.

5 Research Gap

There are contradictory findings by various researchers regarding the causal relationship between FIIs investment and stock market movement in India. Therefore, there is a need to investigate whether FIIs are the cause or effect on stock market volatility in India.

6 Scope of the Study

The present study tests impact of FII?s investment on Indian Stock Market. With India emerging to be one of the leading destinations for Foreign Investments, the role and importance of FII?s in the last few years has increased manifold as a result of globalization of the markets. This study covers the period of 12 years i.e.; from 2000 to 2011. The FII?s are emerging to be a key driver in the movement of stock index and it is imperative to study the relation in order to develop an understanding about the efficiency of the market. In the last decade FII had a significant impact on the unprecedented growth in the Sensex and also in its downfall due to the financial recession of 2007. An attempt is made to carve out a clear picture of the impact of FII?s investment on Indian bourses and also determine the market trend relating to inflows and outflows of FIIs.

7 Objectives

1. To assess the growth and development of Indian Stock Market

2. To develop an understanding about the concept and role of Foreign Institutional Investors (FIIs) in India.

3. To study the relationship between FII?s investment and Indian Stock Market

4. To test the impact of FIIs investment on Indian Capital Market

8 Hypothesis

A. Testing Index Volatility of BSE Sensex with FIIs investment

H0: FII's investment has significant relation with Volatility of BSE Sensex

H1: FII's investment has no significant relation with Volatility of BSE Sensex

B. Testing Index Volatility of SandP CNX Nifty with FIIs investment H0: FII's investment has significant relation with Volatility of SandP CNX Nifty H1: FII's investment has no significant relation with Volatility of SandP CNX Nifty

C. Testing the impact of FIIs investment on Indian Capital Market H0: FIIs investment has significant impact on the Indian Capital Market H1: FIIs investment has no significant impact on the Indian Capital Market

9 Research Methodology

9.1 Data Collection Method

The data analyzed in this paper has been collected from the reliable source i.e. from the Handbook of Statistics and Bulletin published by the Securities Exchange Board of India (SEBI) and Reserve Bank of India (RBI), Indian Securities Market Review, NSE fact book from 2000 to 2010 and internet. The sample consists of yearly net changes in two major stock indices of India viz. BSE Sensex and SandP CNX Nifty, and yearly FII?s Net investment in India as on January, 2000 to December, 2011. The data collected is compiled in the form of tables and graphs and scrutinized through statistical tools and techniques.

9.2 Hypothesis Testing Technique

In this paper, researchers test index volatility of Indian stock market. And for this two major stock indices have been taken i.e. BSE Sensex and SandP CNX Nifty. There may be other factors also on which stock market may depend like inflation, government policies, budgets, FDI, economic and political conditions etc. But in this study only one variable i.e. FII have been selected in order to study its relation with stock market volatility. In this paper the concept of correlation and regression is being. Moreover, ttest is being employed here (as the numbers of observations are less than 30).

10 Analysis and Result

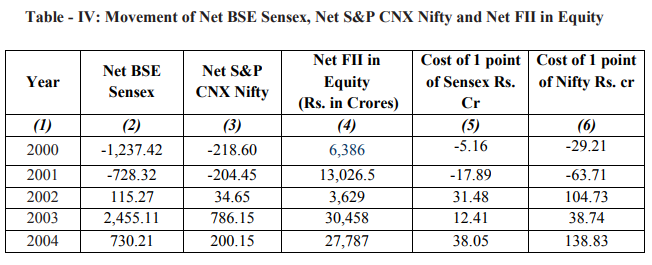

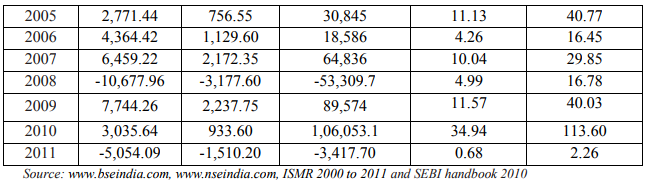

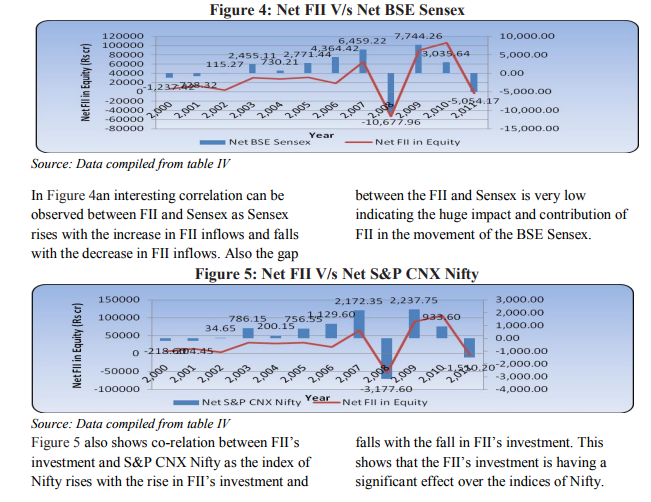

10.1 Analysis and Result based on Graph

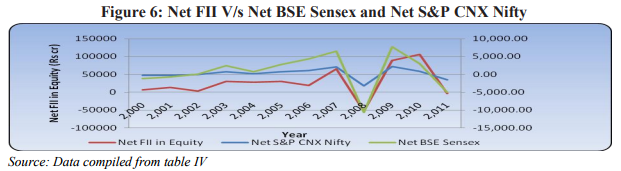

The Charts or Graphical analysis are based on Table-IV. Charts are the best medium through which the study shows the trends of the market. Here with the help of the graphs the study has analyzed the comparative trend of Net FII?s investment in equity with net changes in two major stock indices of Indian Stock Market i.e. Sensex and SandP CNX Nifty and the market?s prime movers spent to move each point in Sensex and Nifty. These graphs also show the relationship between all the three variables i.e. NSE, BSE and FII. Through this study can analyze the impact of FII?s investment on Indian Stock Market as well as Indian Capital Market.

The figures in Table - IV have been depicted in the Figure 4, 5 and 6. From the Figure 4, 5 and 6 study can analyze the comparative trend of FII?s net investment in equity and net change in Indian Stock Market indices for the period 2000- 2011. A business Standard Research Bureau study of monthly inflows data since 2001 shows the market?s prime movers have spent between Rs 5 crore to Rs 50 crore to move each point in Sensex.14 The charts shows that there is an increase in net investment in 2002-05 due to which Sensex and Nifty also rises, then there was a sharp fall in the year 2006. After that there was a steep increase in net investment in the year 2007. This was the best period in Indian Stock Market where stock prices were at a record high and the market was bullish. Foreign investors have been net buyers in 10 of 12 calendars years since 2000. They have been net sellers in 2008, when the sub-prime crisis and Lehman brothers collapse crippled the global markets. That year they spent Rs 5 crore and Rs 16.78 crore for each of the 10667.96 points the Sensex and 3177.60 points the Nifty lost. And in calendar year 2011, Delivery-based buying in the secondary market has hit a fouryear low, down 25 per cent over the past 12 months, as investors preferred to stay away from a gloomy equity market. So, too, for risk appetite, with average trading volume on the BSE and NSE down 23 per cent over the level a year before. The market was volatile and the reduction in the FII?s investment was one of the causes of volatility. FIIs has pulled out around Rs 53,309.7 crore and Rs 3417.70 crore from the Indian stock market and the withdrawal led to a fall by approximately 51 percent and 24.64 percent in Sensex and 20 percent and 24.62 percent in Nifty in 2008 and 2011 respectively. The post-Lehman recovery that started in April 2009 and got an upward push with return of the UPA government at the center, was even more expensive, at Rs 22.7 crore per point in the Sensex.14 In terms of cost per point in Sensex and Nifty, 2004 was the most expensive for FII, when they spent Rs. 38.05 crore and Rs. 138.83 crore for every point in Sensex and Nifty respectively. In year, 2010, was next on the list, with every Sensex and Nifty point costing Rs. 34.94 crore and Rs. 113.60 crore respectively when in last year, 2011 again it bounce backed Rs. 0.68 crore and Rs. 2.26 crore for cost per point in Sensex and Nifty respectively. 2011 was one of the worst years for Indian markets as it fell more than 20% on a Year on Year basis, which makes it the worst performer of 2011 in Asia. Slowing growth, rising inflation, and policy paralysis have blown the Indian markets off course in 2011. 2011 saw high inflation rate dampening the market spirit.

Headline inflation, as measured by wholesale price index (WPI), has been above the 9% mark since December 2010. This in turn led the RBI action of hiking the repo and reverse repo rates consistently 11 times. And now the Interest rate cycle in India is at the verge of peaking out. However, even if this action by RBI could not tame inflation immediately it helped in reducing the growth story of India. The hike in interest rate, inflation and lack of demand in global markets put huge pressure on Indian markets. The IIP data too saw some shameful numbers with October 2011 IIP registering a negative growth of 5.1%. The GDP growth of India was revised down to 7.6 % for the FY 12 by RBI. Indian Rupee too witnessed huge depreciation in value this year. USD/INR crossed 54 levels in December 2011. RBI's move to bring down speculation in the FOREX market has imparted some stability to the rupee. But the move has negatively affected the foreign inflows. The Great Indian Dream seems to be coming to a close as most of the FIIs are pulling out of Indian markets. The FIIs were net sellers this year pulling out their positions.

Figure 6 shows the relationship of FII?s investment with the BSE Sensex and SandP CNX Nifty. From this it can be seen very clearly that the peaks and the troughs of FII coincide with the peaks and troughs of Sensex and SandP CNX Nifty. From all this it can be analyzed that the FII influence the Indian Stock as well as Indian capital market. The graphical analysis indicates the relation is positively correlated and all three appear to be moving in tandem. The rise and peak of all the three curves appear closely related. While the curves for BSE and Nifty are overlapping each other that of FII investments seems to be following the same pattern or trend. It highlights the significant role and proportion of FII on the movement of stock market and also raises certain questions on the basis of past performance. The role is so prominent that withdrawal leads to a massive fall and increase in investment leads to a corresponding rise. Hence, our markets seemed to be reliant and dependent on FII?s raising questions about stability and reliability from the point of view of domestic investors.

10.2 Analysis and Result based on Hypothesis

This study employs the technique of correlation and regression between FII and Sensex and FII and SandP CNX Nifty in order to test the index volatility of Indian stock market in the context of FII?s investment. First of all, the relationship between these three variables viz; NSE, BSE and FII should be analyzed. In the present study, data has been taken on annual basis and it may be so that the data on monthly or daily basis may provide different result.

10.3 Correlation, Regression and T-Test Analysis

Correlation and regression is being calculated in this study in order to analyze the result and t-test is being employed here in order to test the statistical significance of the results calculated which is depicted in Table V, VI and VII. In Table- V Karl-Pearsons? Product Moment Correlation is being calculated which is a simple correlation and shows the relationship between one dependent variable and one independent variable. Here, FII is taken as an independent variable and Sensex and SandP CNX Nifty are being taken as dependent variables, which are taken one by one for the purpose of calculation.

The above table indicates that the correlation between Sensex and FII?s investment is 0.839 which shows high degree of positive correlation. The R-square is 0.704 which means 70.4% of the variance in the variables is explained by this relationship. According to t-test the calculated value at 5% significance level if 0.053 which lies between the critical values + 2.20 reveals that study is not able to reject the Hull Hypothesis. Hence there is significant relation between FII and Sensex. The above table also shows the correlation of coefficient 0.844 of Nifty with FII which indicates there is strong positive correlation. The R-square is 0.712 which implies that 71.2% of the variance in the variables is explained by this relationship. The calculated t-value is 0.048 which lies within the critical values + 2.20 leads not able to reject the Null Hypothesis. Hence there is relation between Nifty and FII. It is further observed from above table that correlation coefficient between BSE Sensex and SandP CNX Nifty is 0.997 that is a very strong positive correlation. And R-square is 0.995 which reveals 99.5% of the variance in the variable is examined. The calculated t value is 0.712 which lies between critical values + 2.16 which empirically proved that the study can not able to accept the Alternative Hypothesis. Hence there is a significant relation of Sensex with Nifty.

Table VI highlights that there is a linear relationship between the variables. It is observed that the value of the slope is 0.098 signifying that for every unit change in X that stands for FII there is a 0.098 unit change in Y or Sensex. On the other hand the intercept is at -1907.21 which seem that FII is playing hottest role in the volatility of Sensex. There are numbers of indicators which influence in the index volatility of Sensex but FII is one of most influencing factor towards index volatility. Significance value is calculated as 0.000649, which is less than the critical value of 0.05 which means not able to accept the Alternative Hypothesis. Hence there is an impact of the FII on the movement of the Sensex.

Table VII highlights that there is linear relationship between the variables analyzed. It is observed that the value of slope is 0.030, which reveals that for every unit change in FII the value of Nifty is moved by 0.030. On the other hand the intercept at -561.31 indicating the role of FII in the movement of Nifty. It means that if the value of FII is zero then the value of NSE or Nifty would be affected by -561.31 units. The significance value is calculated at 0.000555, which is less than the critical value of 0.05. Again it leads to the acceptance of Null Hypothesis. Hence there is an impact of FII on the volatility of Nifty Index. The both the tables VI and VII support fail to reject the Null Hypothesis which signifies that there is strong relation of FII with volatility of BSE Sensex and SandP CNX Nifty, the effect is slightly more pronounced Nifty. It leads to conclusion that FII?s investment has significant impact on Indian Capital Market.

1. Conclusion

Through the statistical tests, data analysis and graphical presentation it has been found that there is significant relation between the FII?s net investment in equity and volatility in BSE Sensex and SandP CNX Nifty as well as between two indices BSE Sensex and SandP CNX Nifty. Hence it is referred that every movement of FII?s investment there is an instant reaction in the Indian Capital Market. The other factors are also influencing on movement of the stock exchanges. The macro factors in the form of the change in the interest rate, inflation and demand and supply in the global market which Indian market has faced in year 2011. Moreover the sovereign debt crisis in Europe took the center stage in pulling the global market down. The factor might be micro in terms to relating profitability and operations of the listed companies or the economic health of the nation. While exploring the impact on volatility in the stock exchanges it should be kept in mind that FII flows are major drivers of stock markets in India and hence a sudden reversal of flows may harm the stability of its markets it was seen in financial recession in year 2007 and 2011 where the FII is the net buyer from 2000 to 2011 excluding two years 2008 and 2011 which leads the heavy investment and selling attitude of FII?s causing a major hurdle in stabilization of market sentiments.

2. Suggestions

The investment scenario in India has been witnessing turbulent times due to high inflation, poor policy implementation by the government. The problems were further accentuated by the Euro zone crisis and pull backed investment by the FIIs leading to a more than 24% decline in Indian Equities in 2011. Strong policy decisions from the government?s side will make India an attractive investment destination which may attract more FII investments for growth of Indian stock market and making the rupee stronger. There is no doubt FIIs are influencing the volatility on indices of stock exchanges to a greater extent. But the role and effect of the FII on the Indian economy should be duly monitored and regulated by government agencies as our economy is still in the developing stage. It is imperative to ensure that the domestic investors are protected from the established foreign players

References:

[1] Link Model, developed by Narendra Singh Bohra available in “FIIs Investment in Indian Capital Market: A Study of Last one Decade”, International Research Journal of Finance and Economics, Issue 68 (2011), pp .103

[2] Purnendra Verma (2001), “Impact of FII on Capital Market – An Empirical study on Indian Capital Market”, pp. 1-19, retrieved from www.scribd.comdoc6988166Impactof-Fii-On (07/12/2011)

[3] Aravind, T. N, et al. (2008) “FII?s Influence in Indian Stock Market”, retrieved from http://www.coolavenues.com/know/fin/subystock-1.php (10/12/2011)

[4] Prasanna P.K. (2008), “Foreign Institutional Investors: Investment Preference in India”, Journal of Administration and Governance, Vol. 3, No. 2, pp. 40-51

[5] Dr. Rahul Singh, et al. (2008), “A Study of FII Investment Flow and SENSEX Movement”, pp. 1-11, retrieved from www.google.com (07/12/2011)

[6] Soumita Patra, et al. (2009), “Impact of FII Flow on the BSE SENSEX and Nifty”, pp. 1-42, retrieved from http://www.slideshare.net/skyranger_007/im pact-of-fii-on-sensex-nifty/download (07/12/2011)

[7] Gaurav Agrawal, et al. (2010), “Investigation of Causality between FIIs Investment and Stock Market Return”, International Research Journal of Finance and Economics, Issue 40, pp. 100-112

[8] Madan Sabnavis, et al. (2010), “Implication of FII Inflows”, Economic Studies: CARE Ratings, pp. 1-5, retrieved from http://www.careratings.comarchive38915.pd f (07/12/2011)

[9] A.Q.Khan and Sana Ikram (2010), “Testing Semi-Strong Form of Efficient Market Hypothesis in Relation to the Impact of FIIs Investments in Indian Capital Market”, International Journal of Trade, Economics and Finance, Vol. 1, No. 4, pp. 373-379

[10] Narendra Singh Bohra and Akash Dutt (2011), “FIIs Investment in Indian Capital Market: A Study of Last one Decade”, International Research Journal of Finance and Economics, Issue 68, pp .103-116

[11] M. Anuradha Reddy (2011), “SENSEX Movement and FII Flows – A Study”, pp. 1-12, retrieved from http://www.wbiconpro.com306-Venkat.pdf (07/12/2011)

[12] Ravi Akula (2011), “An Overview of Foreign Institutional Investment in India”, Indian Journal of Commerce and Management Studies, Vol. 2, Issue 1, pp. 100-104

[13] Dr. Ambuj Gupta (2011), “Does the Stock Market Rise or Fall Due to FIIs in India”, International Referred Research Journal, Vol. 2, Issue 2, pp. 99-107

[14] N S Subramanian and Sameer Mulgaonkar (2011), “FIIS get more bang for bug this year”, Business Standard: Smart Investor, pp. 1 and 4 (14/12/2011)

[15] http://www.sebi.gov.in

[16] http://www.nseindia.com

[17] http://www.bseindia.com

[18] http://www.rbi.org.in

[19] http://www.moneycontrol.com

[20] http://www.business-standard.com

[21] http://www.google.com [22] SEBI handbook of statistics on the Indian Securities Market 2009, 2010

[23] RBI handbook of statistics on the Indian Economy 2009-10, 2010-11

[24] SEBI Annual Report 2009-10, 2010-11

[25] Indian Securities Market Review, from 2000 to 2010

[26] NSE factbook from 2000 to 2011

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License