IJCRR - 4(4), February, 2012

Pages: 125-134

Print Article

Download XML Download PDF

THE EFFECT OF UNCOLLECTIBLE PREMIUM CONNECTED WITH CREDIT TERMS OF INSURANCE SERVICE COMPANIES IN ETHIOPIA

Author: D.Guruswamy

Category: General Sciences

Abstract:Ethiopian Insurance Corporation has many competitors in the Insurance Industry. Recently, there are fifteen private owned Insurance Companies those become the major competitors of the Ethiopian Insurance Company. Now a days Insurance Companies are attractive for new customers and retain the existing one by using different mechanisms. Among these mechanisms selling insurance policy with credit option is one of the customers attracting strategy. Consequently, collection of the accumulated trade debt balance of these credit sales has become one of the difficult problems of the EIC. The general objective of this study is to investigate the effect of uncollectible premium in connection with credit terms of insurance policy in EIC, Mekelle zone, Tigray. The present study is a case study and both primary as well as secondary data are used in this study. In order to examine the aspects of performance, appropriate financial ratios are used. The overall conclusion is that there is a serious problem which the corporation is facing in its credit management process.

Keywords: Credit Management, Ethiopian Insurance Corporation, Premium, Service.

Full Text:

INTRODUCTION

The insurance business in Ethiopia in its modern application is a recent phenomenon. A branch of foreign insurance company known as ?Boise fire insurance company? was opened by an Austrian in Addis Ababa in 1923. For the first time in Ethiopia the company paid compensation to client in 1929 for damage to his store caused by fire. Beginning from this time until the Italian invasion of 1936 some foreign Insurance companies were operating through their agents. During the Italian occupation of Ethiopia from 1936-1941, Italians Insurance companies operated and non–Italian companies were closed down. During the pre-military government the Ethiopian economic policy was designed in such a way that encourages the establishment and growth of private owned insurance companies in the economy. But after the military government came to power in 1974 the corporation came in to existence by taking over all assets and liabilities of the thirteen private insurance corporations were nationalized in January1975, and amalgamated to create Ethiopian Insurance Corporation. As result of this action the industry was monopolized by Ethiopian Insurance Corporation for about a couple of decades. After the down fall of the military government the existing government comes up with attractive, as well as ideal economic policy which highly encourages the establishment and expansion of privately owned insurance companies to operate in the insurance industry owning to this conductive economic policy, more than seven privately owned insurance companies joined the insurance industry since 1991 Ethiopian insurance corporation was established by proclamation No.68/ 1975 on 1st January 1976. Currently, EIC operating the insurance industry with a grand mission of producing its customers all efficient and reliable insurance services which cover life, property, and liability risks. EIC provides its service by giving a paramount importance to its customer‘s safety and satisfaction by making use of the right mix of expertise, and cost effective strategies. EIC established with birr 11 million in 1976, and re-established as public enterprise under proclamation number 201/94 with birr 61 million paid up capital. Ethiopian Insurance Corporation was among the huge financial institutions that provide services to their customers for the sake of profit making considering the following objective:

- Engage in all classes of insurance business in Ethiopia.

- Ensure the insurance service reach the broad mass of people.

Ethiopian Insurance Corporation is expected to be competitive and profitable as other insurance companies by attracting new customers and providing the required services in an efficient way to hold their existing customers.

STATEMENT OF THE PROBLEM

Ethiopian Insurance Corporation has many competitors in the Insurance Industry. Recently, there are fifteen private owned Insurance Companies those become the major competitors of the Ethiopian Insurance Company. Now a days Insurance Companies are attractive for new customers and retain the existing one by using different mechanisms. Among these mechanisms selling insurance policy with credit option is one of the customers attracting strategy. Consequently, collection of the accumulated trade debt balance of these credit sales has become one of the difficult problems of the EIC. There are some indicators that customers with long and huge unpaid debt balance called debtors, are shifting to another company as a means of escaping, at least temporally from their debt strain. When the insurance company is demanding settlement to the uncollectible premium may array due to the problem credit policy of EIC. Customers are unable to settle their obligations due to their own problems or it may be related to poor receivables management of the company. The researcher focused on these fundamental problem areas and to indicate inefficient areas in order to correct weakness of EIC in Mekelle zone. As to the best of the researcher‘s knowledge, there is no previous research work on ?the effect of uncollectible premium in connection with credit terms of EIC in Mekelle Zone, Tigray.? This; therefore is the rational for undertaking this study to fill gap.

OBJECTIVES OF THE STUDY

The general objective of this study is to investigate the effect of uncollectible premium in connection with credit terms of insurance policy in Ethiopian Insurance Corporation, Mekelle zone, Tigray by considering the following specific objectives:.

1. To show the effect of uncollectible premium on the operating activity of EIC

2. To indicate the effect of uncollectible premium on the profitability of the company

3. To show the methods and procedures of credit policy analysis adopted by the company

4. To identify the major reasons for uncollectible premium in the company

5. To detect the fundamental areas of uncollectible premium in the company

6. To analyze the strengths and weakness of the company‘s credit policy

METHODOLOGY

The present study is a case study. In order to achieve the above mentioned objectives, the researcher collected and revived relevant documents and reports from both secondary and primary data sources. The primary data are collected from the insurance users and from the personnel‘s (staff members) of the corporation by conducting interviews. Random sampling technique is used in order to select the Insurance users and personnel‘s of the corporation for conducting interviews. The secondary source for this study is from Annual Reports of the company, documents, news papers, articles and books. In order to examine those aspects of performance from 2007 to 2009 appropriate financial ratios are used to analyze the EIC balance sheet and income statement. It is extremely used upon the analysis of financial statement of EIC and seeks to detect any inefficient areas and explain the cause and effect of uncollectible premiums due to the credit sale of insurance policies in EIC.

SIGNIFIACNE OF THE STUDY

This study may have due importance for facing different kinds of uncollectible premium and to take corrective actions or be aware of the employers and the customers especially in insurance corporations.

SCOPE AND LIMITATIONS OF THE STUDY

This paper is concerned only with the effect of uncollectible premium in connection with credit terms of insurance service of Ethiopian Insurance Corporation, Mekelle zone and the study period was limited from 2007 to 2009.

DATA ANALYSIS AND PRESENTION

As pointed out in the data source the subjects or targeted population of the research are the insurance users and staff members with the objective of knowing the reasons of uncollectible premium from the credit sales insurance service and its consequence. In addition, Annual reports of EIC from year 2007-2009 are important source of data which is presented using tables. Now the researcher describes the insurance services to the customer and the objective of EIC before describing the reasons of uncollectible premium. Modern business practices permit delivery of goods and services without immediate payments. This practice is also common in insurance policy transaction. Insurance company‘s sales, insurance policies on account and the insured agree to pay the premium on some specific date in the future. The primary inspiration of providing insurance services on credit is to fill the gap between the real need of insurance service and temporally financial strain of the insured to effect immediate payment for it. This in return strengthens good business relationship between the insured and the insurer, and helps insurer to achieve its sales target. Ethiopian Insurance corporation has a mission of protecting the public from unexpected and accidental loss in providing customer focused; efficient and reliable insurance services. The main objective is to raise its profitability and market share by providing efficient, reliable and cost effective insurance services To attract new customers and retain the exiting one‘s insurance companies introduced a provision of insurance services in credit terms and sometimes they can extend the term of outstanding credits. Consequently collection of the accumulated trade debt balances has become one of the difficult problems of the insurance. Reasons for uncollectible premium Based on the interview, the researcher has summarized the following reasons for uncollectible premium. The primary benefit of credit sales could be summarized to increase profits through increasing sales. Due to the fast environmental changes and with other factors the expected amount of premiums was collected partially or may not be collected at all. These situations may lead the company to incur financial loss and if it was material the company may become bankrupted. There are many reasons for the receivables that become uncollectible where as the problem of uncollectibility may arise due to the companies weakness or customers failure to meet the contract. Among the problems which have mentioned from the company in Mekelle zone side weakness of customer selection procedure, lack of clarity in terms of setting credit terms (such as credit limits, credit period, settlement discounts) and inefficient collection policy were the major ones. Whereas, customers negligence that is customers are unwillingness to continue with the service or when the customer business become bankrupted, the customer fails to meet the insurance contract. Credit term is a sales attraction mechanism and the longer the time a company allows its customers to pay the greater the volume of sales and also the profits. However, the longer the credit terms the greater the amount of debtors and the greater the possible strain on the company‘s‘ liquidity. But in order to minimize the uncollectible premiums and also to improve the profitability of the company a sound and effective credit policy is necessary.

The effect of uncollectible premium

The effect of uncollectible premium on the EIC, Mekelle zone is summarized as per the interview results. There is a common truth that, for a given level of return there is also certain level of risk attached with it (that is high returns to high risk). In any business when goods or services are provided in credit there is a risk of uncollectible. The main difference is the probability of this uncollectible from one company to another and from one business to another depending on the firm‘s internal and external environmental conditions and also due to customer‘s behaviors. Ethiopian Insurance Corporation provides its services on credit for governmental organizations, public agencies, financial organization and also private sector. Hence EIC sets restrictions in the provision of credit to its customers to reduce the risk of uncollectibility. Regarding to the down payment of any governmental organization has the chance to get various insurance services without any down payment. Whereas, for private companies to get insurance services in credit the company have to pay 50% of the down payment in cash immediately when enters in to the contract. Note that life related insurance services were not provided in credit terms for any sector. A credit policy should outline a company‘s strategic and operations requirements from credit sales. It is not sufficient to provide credit to customers, but it is also necessary to evaluate what the company expects from this credit sales i.e., increased sales, attract new customers, improved profitability and increased market share. It is obvious that all of the above are driven with the aim of producing profitable growth and not as service to be abused by customers. Whatever credit terms a company (EIC) may like to offer it can be limited by the practice of the industry; and the choice of which customers to sell is really a question of the level of risk of non- payment that is considered acceptable with every credit sale, there is some level of risk that the customer will either take a considerably long time to pay or may not pay at all. The uncollectible of this premium has many side effects on the financial activity, profitability and solvency of the company. The financial activity of EIC was classified as life and non- life business activity. EIC provides insurance services in credit term only for non life business related actives, although there are other kind‘s life of credit provided under life business activities, such as sundry debtors, staff debtor‘s prepayments and deposits. Interest and rent receivable are the major debtor accounts for the credit provided. Among the effects of uncollectible premium the reduction of profitability was the major one. Uncollectible premiums are reflected as an expense on provision for doubtful debts account under non- life business profit and loss account. In this situation, it is necessary to consider how much portion should take in each sector as uncollectible premium (i.e., governmental sector, public agencies, private sector and financial institution).

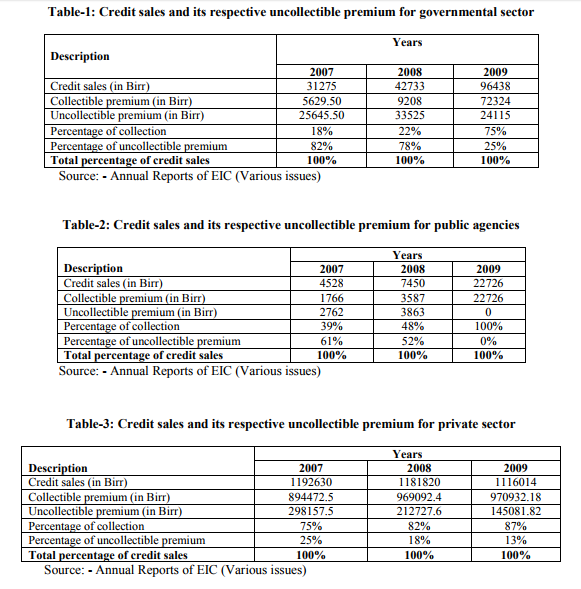

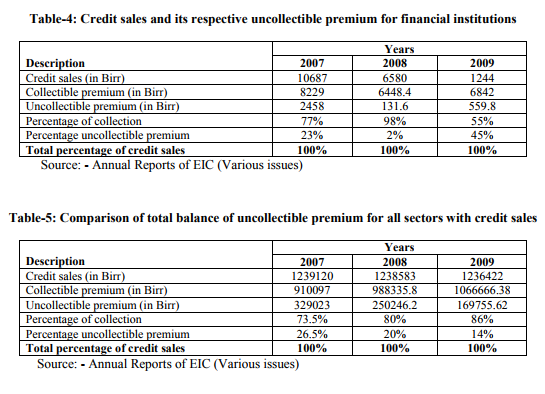

Table-1 about here

Table-1 shows that the amount of uncollectible premium of governmental sector is decreased from year to year (from 2007 to 2008 and 2009). As it can be further observed from table, the share of 82% uncollectible in the year 2007 is declined to 25% in the year 2009. Furthermore, as per the interview results the decreased trend of uncollectible premium is as a result of privatization of the government companies. The average rate of uncollectible for this sector was 61.7%. It concludes that the amount of collection is increased from time to time in contrast uncollectible premium is decreased at increasing rate.

Table-2 about here

As it can be seen from the Table-2 that the amount of uncollectible premium of public agencies is decreased from 2007 to the next year and in 2009 all credit sales were collected and on average rate of uncollectible premium was 37.7% for each year (From 2007-2009). Generally the credit sales collection is increased at an increased rate from time to time and uncollectible premium is decreased and it becomes zero in 2009. From this one can conclude that the uncollectible premium becomes zero in the year 2009 for public agencies.

Table-3 about here

As it can be seen from the Table-3 indicates that the level of uncollectible premium of private sector. The rate of uncollectible premium of this sector as shown is decreased from year to year at a moderate rate. On average the rate of the amount of uncollectible premium covers 18.67% from the total credit sales in a given three years. It concludes that the above table shows the amount of collection is increased from year to year like that of government sector and public agency but the uncollectible premium is decreased continuously since various government policies have been changed over the past decades and EIC highly focused on private sector credit policy.

Table-4 about here

As it indicated in Table-4 that financial institutions are the smallest class of customers when it compared with other three classes of customers. The credit sales amount is decreased from year to year. The uncollectible premium is decreased at an increased rate from 2007-2008 and increased at an increased rate in 2009. On average the percentage of uncollectible for this sector was 23.3% in the given three years. To summarize the above four sectors, next to private sector, financial institutions covers the least average rate of uncollectibility compared with the other two sectors (government sector and private sector).

Table-5 about here

As it shown in the Table-5 that the uncollectible premium is decreased from year to year similarly the credit sales amount also has been declined for consecutive years. In 2007, an uncollectible premium covers 26.5% of the total credit sales and this rate becomes decreased for the year 2008 and 2009 to 20% and 14% respectively. As it shown, the rate of uncollectible amount is decreased from year to year. Its receivables are not collected timely; the provision of credit terms may become a means of resource wastage rather than a profit generating mechanisms. Improving with the process of collecting these uncollectible premiums is necessary to consider legal cost, time value of money and other related costs. It is obvious that credit option of providing insurance services is driven with the aim of producing profitable growth. Then the objective of the company is assumed to choose the credit policy that takes in conjunction with its other policy decisions to maximize its expected profits. It is known that the credit policy cannot be formulated without reference to constraints. The liquidity position of a company presents obvious constraints, the production capacity, management capacity and risks are the major effects of uncollectible premium. When these problems, reaches the high level, the company‘s business activity fell down and become bankrupted. In order to minimize this risk and to create conducive business environment it is necessary to establish a sound and efficient credit policy. Customer selection procedures, credit terms and efficient collection policy matters should given attention in establishing the credit policy. Now it is an important to observe; EIC‘s credit policy and procedure, the strategies used in credit granting in EIC, and the problems in EIC credit control and its management.

Credit policy and procedure of EIC

For number of years, employees of the corporation are faced serious problems in managing credit sales. A great number of directives were issued from different offices of the corporation. The directives are simply to give solution to the problems at hand. As these directives are many in number and are issued from different offices, it was very difficult to implement them and also to exercise adequate control towards their implementation and their suitability to meet the needs of the market. After taking some years, the corporation is able to prepare its credit policy directives and procedures in 1995. This policy directives and procedures repealed all the previous directives issued through out the years. But these documents are also too cumbersome to comprehend and implement it. There were wide oppositions to these documents among the staffs regarding to the implementation of the directives.. Recently, the corporation produced yet another credit policy and procedure at the end of year 2000. The policy requires the corporation to comply with the laws and regulation of the government, directives of the National Bank of Ethiopia and the strategy and credit policy of the corporation in its management of credit. In addition to this, the policy is based on certain principles which emphasize meeting of the profit motive of the corporation. The corporation credit policy requires that a credit audit be conducted by the responsible body. The credit audit is to be performed by credit audit unit, which is outside the credit unit, and which directly reports to the board of management of the corporation and have an access to the president of the corporation. The main task of credit review is independently reviewing the quality and management of credit risk all over the corporation. The review included all sorts of activities undertaken in credit management. The unit responsible for credit review is required to produce a report that includes findings, conclusions and recommendations.

Strategies used in credit granting in EIC

Based on the out comes, the corporation may consider one or the combination of the following strategies, to meet the interest of both customers and the corporation.

- Convince the customers that defaulting damages their names and social standing and make them pay past due balances.

- Re-scheduled the credit by reviewing the terms and preconditions, at the same time the customers can be requested to pledge additional security and to pay a portion of the credit as a good gesture.

- Allow the customers to liquidate the asset of their company at their own terms and conditions.

- Not every credit that defaults (becomes uncollectible) is immediately forwarded

to the work out credit unit. Normally a credit is considered as defaulted staring from the first day repayment is past due but this does not mean that EIC start taking action, rather it waits until the customers are not able to prepay for 90 days. During this time, the corporation tries to inform the customers through the servicing branches, giving them oral and written reminders. And these credits that reach the critical stage, despite the branches efforts will be transferred to workout loans unit.

- In accounting, when goods and services are provided in credit the transaction is recorded in special ledger account (for example account receivable or notes receivable). After that the company can estimate what portion of its credit sales become uncollectible. These uncollectible debts are known as doubtful debts.

- After under going through the work out credit process, some credits cannot be recovered for various reasons. Therefore, when EIC is left with no other option of recovery of the premium as a result the company takes foreclosure and litigation as the next step. Some of the situations, which might lead EIC to foreclosure are:

- The business has turned out to be insolvent and incapable of generating cash to repay the claims incurred.

- The borrowers or their business fails to pay minimum cash down payment required by the agreement.

- The borrowers become uncooperative to resolve the problems amicably.

Problems of credit management in EIC

During the interview the respondents pointed a number of problems which are the main causes of the premium to be uncollectible in the EIC. Although when EIC provides its insurance service in credit (future payment) to its customers, EIC considers some situations but there are problems in the process of credit provision. Based on the interview results the problems are classified into internal and external for convenience. The respondents believe that the following are main problems that contributed to the poor performance of the corporation which is expressed by the rising level of uncollectible premiums. The internal problems are as follows:

- Lack of unified policy and procedure for along period of time even though a new economic system was adopted in Ethiopia. This resulted in introduction of a number of directives issued by different authorities which created a lot of confusion among staffs of the corporation that employed in the credit management including control.

- The introduction of inflexible stringent and unmanageable credit policy and procedure which was desired to prevent certain practices and to strengthen control without considering the problems associated with it.

- A very long service delivery time which was caused by task duplications at various stages of the corporation in the inexperience of the credit staff in processing the customer request.

- A very long property valuation and documents checking process irrespective of the type of customer and requested products type.

- Absence of research work to prove the credit staff with appropriate information about the national, international, geographical, sector information which could increase their performance.

- Poor negotiation skill from the credit staff side and absence of any guidance to this effect from the top management and absence of standards, which creates lack of confidence to the staffs. Where as the external problems are mentioned below:

- Absence of record keeping, which creates difficulties in preparing true financial statement

- Absence of adequate cooperation from various government offices to provide information

- Strategies directives issued by the National Bank of Ethiopia such as indiscriminate credit information requirement irrespective of the type, size and the credit contract.

- The communicative effort of the problems raised above caused poor credit management in EIC. This was expressed by customer dissatisfaction, long credit processing time, inefficiency in credit assessment and decision making, employee dissatisfaction, reduce customer loyalty to EIC, lack of creativity and initiative from the credit staff, loss of marketing shares inefficient manpower utilitarian, resource utilitarian and the increasing rate of uncollectible premium were out comes of the problems

CONCLUSIONS

The structure of the insurance industry in Ethiopia is changing with the changes made in policies of the various governments. It is able to see that the corporation provided insurance services in credit with classifying customers as government sector, public agencies, private sector and financial institutions. It is observed from the totaled amount of uncollectible premiums the provision held for the bad debt credit by corporation. The researcher can conclude that there is a serious problem which the corporation is facing in its credit management process. The fact that EIC is not able to quickly adjust to the new economic order is a great weakness in the corporation‘s credit management process. In the earlier years, the corporation is more traditional in its credit management outlook. Moreover, the credit management process was highly bureaucratic. Whatever is the amount and the type of credit the request of the customer should pass through a number of units and practically, no value addition can be observed at the level of most units. Therefore, it was simply a waste of time and can be considered as that the corporation was never been customer oriented. It is because of all the above short comings that the problems mentioned in the body of the paper are able to come in to picture. Clearly setting the credit terms(such as credit limits, credit period, settlement discount ) and efficient collection policy, and customer awareness and willingness to continue with the service or when the customer business become bankrupted, the customer not fails to meet the insurance contract.

ACKNOLEDGEMNT

The author is thankful to management of Ethiopian Insurance Corporation (Mekelle Zone) for cooperation and providing various issues of annual reports. The author is also thankful to insurance users and personnel‘s (staff members) of the EIC for providing the relevant information to carry out this research.

References:

1. Cummins, J. David, 1988, ?Risk Based Premiums for Insurance Guaranty Funds,? Journal of Finance 43, No. 4 (December): 823-839.

2. Emmett J. Vaughan, ?Fundamentals of Risk and Insurance,? 6th ed. (1992).

3. Ethiopian insurance corporation Medhin special issue Januaru 2006.

4. Jorion, Philippe. ?Financial Risk Management,? (New York: Basil Blackwell, 1998)

5. May, David G. ?Integrated Risk; Reaching Toward Risk Management Heaven.? Viewpoint Quarterly, Marsh and McLennan Companies, Winter 1996

6. Negarit Gazeta proclamation No 86/1994 licensing and supervision of Insurance Business proclamation feb 1994

7. Negarit Gateta proclamation No 68 of 1975 Ethiopian Insurance Corporation Establishment proclamation Dec 12,1975

8. Negarit Gateta proclamation No 86 of 1994 Ethiopian Insurance Corporation Establishment proclamation Dec 12,

1995

9. Nottingham, Lucy. ?Integrated Risk Management.? Canadian Business Review 23, no. 2 (1996): 26–28

10. Paisley, P. "What Your Insurance Company Doesn't Want You to Know." Disaster Recovery Journal (Spring 1997): 32-33

11. Taylor, Greg, 1994, ?Fair Premium Rating Methods and the Relations between Them,? Journal of Risk and Insurance, Vol. 61, No. 4 (December): 592-615

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License