IJCRR - 5(7), April, 2013

Pages: 09-16

Date of Publication: 18-Apr-2013

Print Article

Download XML Download PDF

INVESTIGATING THE EFFECTS OF DEMOGRAPHICS ON CUSTOMER ACCEPTANCE OF eBANKING IN DERA ISMIL KHAN, KPK, PAKISTAN: A SURVEY OF SAMPLE CLIENTELE

Author: Muhammad Siddique, Afia Saadat

Category: General Sciences

Abstract:eBanking and iBanking are the buzzwords among internet-savvy population of the world. It is happening not only in the advanced countries but also in the developing states like Pakistan. This is because on one hand the Information and Communication Technologies have become accessible both in terms of availability and prices and on the other hand due to the emergence of local Information technology professionals equipped with knowledge and command over the leading-edge technologies. However, research on the implementation of Information technology in the banking sector reports that the process is not automatic rather requires multi-disciplinary treatment with keeping the issues of customer acceptance on top. The customers of every state and city are different not only because of getting different eBanking digital facilities (digital-divide) but also due to the fact that every customer is demographically different from others. This research is about the effects of demographics on Customer Acceptance in Pakistan. The literature from developed states and developing states, including Pakistan has been analyzed to understand the problem and to develop a research model for testing in the native environment.

Keywords: Customer acceptance, Demographics, eBanking, iBanking, ICTs, Internet.

Full Text:

INTRODUCTION

In the last two decades of the 20 th century the information technology revolution led to a proliferation of personal computers (PCs), modems, servers, and other associated electronic data terminal equipment. This rapid growth and expansion of IT and telecommunication networks and interconnectivity encouraged the introduction of electronic services in the banking sector (Banan, 2010). All transactions occur on a secure server of a bank via internet. The bank has all of the required data and software to execute the transactions. Customers go the bank's Web site, log in, and then take advantage of the bank's internet services. Typical bank services are account access and review, bill payment, transfers of funds between accounts, and a variety of new products and services (Ahmad and Al Zu?bi, 2011) In the eBanking context, the attitudes of customers vary in terms of perceptions regarding services offered, product information, delivery terms, form of payment, risks involved, security, privacy, visual appeal, personalization, navigation, entertainment, and enjoyment (Jahangir and Begum, 2008). TAM describes that the attitude is based on the prominent belief which a person has about the consequences of a given behavior and his appraisal of those consequences. Customer attitude is based on characteristic beliefs about the object and perceived value of those characteristics in making the decision to adopt (Adesina and Ayo, 2010). In this study the effects of demographics on customer acceptance have been studied. Compatibility of iBanking with the lifestyle, eliefs, and experiences of current users has added influence on the intention to carry on using eServices. This suggests that users are more meticulous with an innovation that is closer to what they already know and use (Tat et al., 2008). Customer demographics play an important role in shaping their behaviors towards new technologies. Demographics have been identified as the important variables in affecting the customer acceptance of eBanking (Wahab et al., 2009).

LITERATURE REVIEW

What is eBanking? eBanking is the term which explain the provisions of various services by a bank to its customers through electronic means of communication like computer or television. Thus, eBanking refers to the provision of information about the bank and its products and services through the World Wide Web (Daniel, 1999). The iBanking refers to the viewing of accounts information, transfer of funds, making payments, documentary collections, etc over the Internet (Goldfinger and Perrin, 2001:4; Singh et al., 2002). Banks have used Information and Communication Technologies in the past to drive ATM machines, process checks, and prepare bank statements and the customers rarely noticed the Information System and the use of computers in the banks. But in today?s time, the Web site, email, and the electronic bills payment system are the main gadgets available to the banking customers (Singh et al., 2002). Advanced information technology has a great role in developing easy, convenient, and user friendly banking services. That is why eBanking has captured greater attention of all the stakeholders in the banking and commerce industry (Jahangir and Begum, 2008).

Customer Acceptance

Adoption can be defined as the acceptance and sustained use of a product or a service (Alam et al., 2009). Most of the customers use online banking for bills paying purpose, and they just do it quiet often with least effort. Besides that, people use iBanking to keep an eye on their money matters, view their account balance and check the received payments from other parties (Yang and Ahmed, 2009). eBanking users? attitudes vary on the basis of product information, services offered, form of payment, delivery terms, and risks involved (Wahab et al., 2009). The understanding of customers? adoption of eBanking can help financial institutions to formulate competitive marketing strategies and strategic IT planning in banking (Al Mudimigh, 2007). In this context, the major factors affecting iBanking adoption are: customer demographics, customer awareness, ease of use, security and privacy, cost of using iBanking, resistance to change, and digital access (Alam et al., 2009). eBanking does not only include the way one shops over the internet, but also the way one performs banking transactions. It allows more independence to customers in the choice on where and when to bank (Yang and Ahmed, 2009).

Effects of Demographics:

There is a series of research studies on the measurement of demographic implications on the users of computer based information systems including eBanking (see for example, Ramayah et al., 2003; Shih, 2007; Padachi et al., 2007; Yang and Ahmad, 2009; Adesina and Ayo, 2010; Amin and Ramayah, 2010). Demographics have been identified as the intervening and/or moderating variables and have an important role in the case of customer acceptance of eBanking (Tat et al., 2008; Wahab et al., 2009). Similarly the researchers have explored and tested several demographic characteristics however some of these are very frequently used in researches on eBanking. These characteristics nclude: Gender, education, marital status, position (Ramayah et al., 2003); age, education, and income (Padachi et al., (2007); experience with eBanking, experience of using Internet, and frequency of use at least once a week Shih, 2007); gender, marital status, education level, and religion (Amin and Ramayah, 2010). In this research the researcher has used the following demographics for analysis: Respondent Type, Education, Gender, Age, Experience with eBanking, eBank(s) used, and Frequency of Use. The challenge to banks is to realize the diversity of their customers and find the right delivery mix to profitably deliver their products and services to various markets (Comptroller, 1999:4). Thus, user demographics have significant impacts on the customer acceptance of new technologies and this has been established by several researchers over and over that any digital initiative for eBanking cannot be successful unless the issue of customer acceptance is analysed through the filters of their demographic attributes (Suh and Han, 2002; Banan, 2010; Adesina and Ayo, 2010).

RESEARCH METHODOLOGY

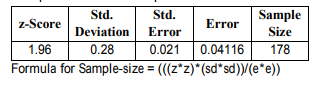

Survey Approach: Given the human and social nature of the research project (Customer Acceptance), the researcher has applied survey approach since urveys are “excellent vehicles for measuring attitudes and orientations in a large population” (Sekaran, 1999:257). Survey approach has been used to measure the user attitudes towards new technologies. For example, researches are available on "Usable Security and eBanking: Ease of Use vis vis Security (Hertzum et al., 2004)”, “What keeps the eBanking customer loyal? Role of consumer characteristics on eLoyalty (Floh and Treiblmaier, 2006)”, “Analyzing the Factors that Influence the Adoption of iBanking in Mauritius (Padachi et al., 2007)”, “SMS banking: Explaining effects of attitude, social norms and perceived security and privacy (Amin and Ramayah, 2010) are a few projects to quote. Population and Sample The population of this study consists on all the literate customers of eBanking in Dera Ismail Khan, KPK, Pakistan. Their number is infinite due to the fact that the eBanking customers are increasing day by day and every bank is trying its level best to shoot up the size of their customer banks. However, the researcher has classified them into five major groups, i.e., bank employees, teachers, students, doctors, and businessmen. The researcher used a pilot study to measure the level of error in responses and then used the same pilot data for determining the size of the required sample. Table 1 details the results of pilot study and the use of statistics for determining the sample for this study is 178. However, 173 questionnaires were received and qualified as usable for analysis therefore the return rate was 97.19%.

Table 1. The „Statistics? from Pilot Study and Computation of the Sample Size

Data Collection

1. Literature Survey: Initial literature survey provided concepts relating to the topic, their mutual relationships and the theoretical model underlying these relationships. It was continued in the main research to further mature the research design and feed the topic.

2. Questionnaire: Questionnaire is instrumental to the survey research. A structured questionnaire has been prepared strictly according to the extracted variables and guidelines for questionnaire construction (Goode and Hatt, 1952:133; Babbie, 1993:146).

A structured questionnaire was extracted from the literature containing seven (7) demographic items and one research variable (customer acceptance). All the research questions were measured on a 5 point Likert scale representing 1 = strongly disagree, 2 = disagree, 3. neutral, 4 = agree and 5 = strongly agree. The same scale has been widely used by the researchers on the customer acceptance of new technologies (Daniel, 1999; Chau and Lai, 2003; Mashadi et al., 2007; Tat et al., 2008; Jahangir and Begum, 2008; Alam et al., 2009; Banan, 2010; Adesina and Ayo, 2010).

Data Analysis

Data has been analyzed both in descriptive and inferential manners according to the requirements of hypothesis, generated from the literature. Following statistical tools were applied to test the hypothesis:

a. ANOVA applications

b. Tests

c. Regression analysis (step wise)

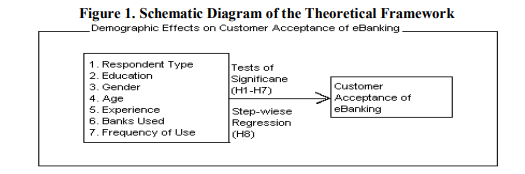

Research Model

This research model is developed on the basis of literature review showing the relationships of customer demographics on their behavior towards eBanking acceptance.

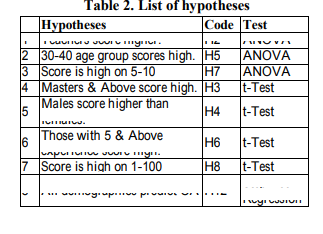

Hypotheses

Following hypotheses were tested in this study:

RESEARCH FINDINGS

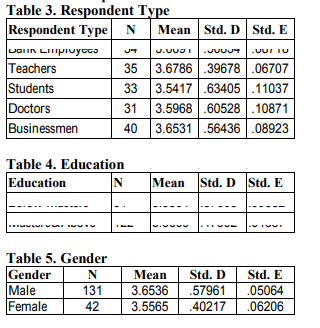

Descriptive Statistics of Respondents for

Customer Acceptance:

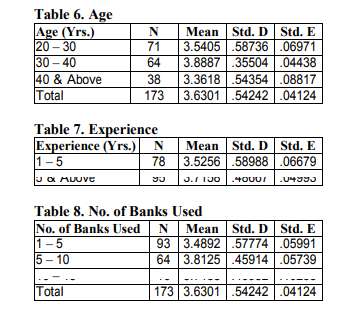

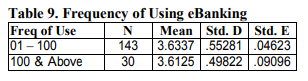

a. Testing the Significance of Mean Differences This section presents the results from the tests of significance applied on testing the mean differences between different groups emerging from the demographic attributes of the respondents. Tests have been applied on the role of RTP (respondent type), EDU (education), GDR (gender), AGE (age), EXP (experience), BKU (banks used) and FOU (frequency of use).

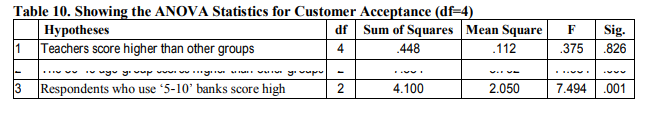

1. ANOVA tests:

The above table shows the results of three ANOVA tests for hypotheses testing. Here, we can see that second and third hypothesis have been accepted due to the p value less than 0.05 (i.e., 0.000 and 0.001 respectively), whereas as the first hypothesis has been rejected because of the p value greater than 0.05 (i.e., 0.826).

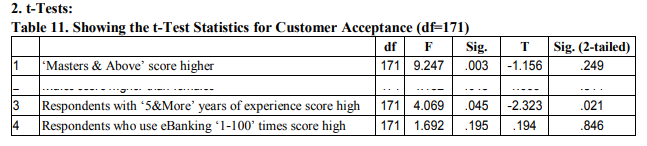

The above table shows the results of four t tests for hypotheses testing. Here, we can see that the third hypothesis has been accepted due to the p value less than 0.05 (i.e. 0.021), whereas as the first, second, and fourth hypothesis have been rejected because of the p value greater than 0.05 (i.e., 0.249, 0.314, and 0.846 respectively).

b. Predicting the Customer Acceptance (CA) with Demographics Hypothesis 8. All the demographics predict Customer Acceptance (CA).

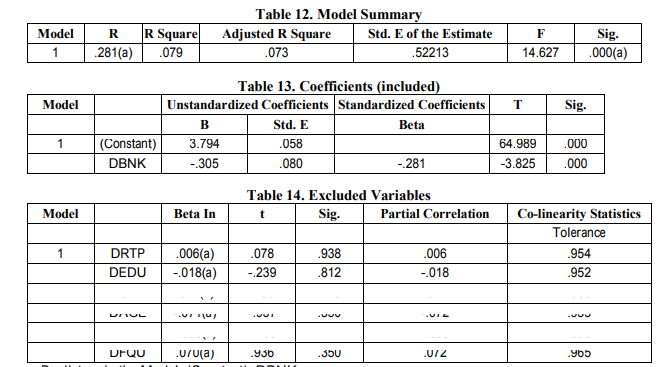

a Predictors in the Model: (Constant), DBNK

b Dependent Variable: CA

The table 12 show the summary results of Demographic impact on Customer Acceptance (CA). However, the only Demographic Banks Used (DBNK) shown in table 13 is having significant effect on Customer Acceptance because of the p value less than 0.05 which is the deciding point. Whereas the other demographics (as shown in table 14) DRTP (p value = 0.938), DEDU (p value = 0.812, DGDR (p value = 0.775), DAGE (p value = 0.350), DEXP (p value = 0.447) and DFQU (p value = 0.350) are insignificant in determining Customer Acceptance (CA) due to p values greater than 0.05, which is the required threshold. Hence, the hypothesis is partially supported with one out of seven (1/7) demographics.

CONCLUSIONS

In this research the researcher has studied the effects of seven demographics, i.e., Respondent Type, Education, Gender, Age, Experience with eBanking, eBank(s) used, and Frequency of Use. However, it has been seen that the demographics play a very little role in predicting the Customer Acceptance of eBanking. For example, the only demographic Banks Used (BKU) has an important role in predicting Customer Acceptance (CA). Similarly taking into account the demographic attributes of the respondents it has be seen that out of seven (7) tests of significance only three (3) were proved significant.

Thus, following conclusions have been drawn from the current empirical study:

1. The demographics have indicated no role in the prediction of CA.

2. In Customer Acceptance „The Banks Used? is the only critical factor.

3. The Role of demographics is mixed as a whole (3/7), i.e., 43%.

4. Age, banks used, and experience are the demographics having significant mean differences for customer acceptance.

ACKNOWLEDGEMENTS

Authors acknowledge the great help received from the scholars whose articles cited and included in references of this manuscript. The authors are also grateful to authors / editors / publishers of all those articles, journals and books from where the literature for this article has been reviewed and discussed. Using this opportunity the authors put their appreciation in black white for the assistance of friends and particularly the respondents who played an important role in data collection. Finally, authors are grateful to IJCRR editorial board members and IJCRR team of reviewers who have helped to bring quality to this manuscript.

References:

1. Adesina, A.A. and Ayo, C.K. (2010). An Empirical Investigation of the Level of Users? Acceptance of E Banking in Nigeria. Journal of Internet Banking and Commerce, 15(1). Retrieved June 18, 2011, from http://eprints.covenantuniversity.edu.ng/83 /1/Adesina.pdf.

2. Ahmad, A.M.K. and Al zu?bi, H.A. (2011). E banking Functionality and Outcomes of Customer Satisfaction: An Empirical Investigation. International Journal of Marketing Studies, 3(1): 50 65. Retrieved September 10, 2011, from http://www.ccsenet.org/ journal/index.php/ijms/article/view/9273/6838

3. Alam, S.S. Musa, R. and Hassan, F. (2009). Corporate Customers? Adoption of Internet Banking: Case of Klang Valley Business Firm in Malaysia. International Journal of Business and Management, 4(4): 1 21. Retrieved September 29, 2010, from http://www. ccsenet.org/journal/index.php/ijbm/article/view/ 1126/1076

4. Al Mudimigh, A. S. (2007). Business Strategy in an Online Banking Services: A Case Study. Journal of Internet Banking and Commerce, 12 (1): 1 8. Retrieved August 11, 2011 from http://www.arraydev.com/commerce/jibc/2007 04/abdullahfinal pdfversion. pdf

5. Amin, H. and Ramayah, T. (2010). SMS banking: explaining the effects of attitude, social norms and perceived security and privacy. Electronic Journal of Information Systems in Developing Countries, 41(2):1 15. Retrieved June 26, 2011, from http://www.ejisdc.org/ ojs2.../index.php/ejisdc/article/view/638/315

6. Babbie, E. (1993). The practice of social research. 7 th ed. Wordsworth Publishing Co.

7. Banan, M.R. (2010). banking and Managerial Challenges. Georgian Electronic Scientific Journal: Computer Science and Telecommunications, 1(24): 13 23.

8. Chau, P.Y.K. and Lai, V.S.K. (2003). An Empirical Investigation of the Determinants of User Acceptance of Internet Banking. Journal of Organizational Computing and Electronic Commerce, 13(2): 123 145. Retrieved October 21, 2010, from http://hub.hku. hk/bitstream/ 10722/43542/1/81747.pdf

9. Comptroller. (1999). Internet Banking: Comptroller?s Handbook. Comptroller of the Currency Administrator of National Banks. Accessed on 10 June 2010. Retrieved October 21, 2010, from http://www.occ.treas.gov/publications/publicati ons by type/ comptrollers andbook/intbank.pdf.

10. Daniel, E. (1999). Provision of electronic banking in the UK and the Republic of Ireland. International Journal of Bank Marketing, 17 (2):72 82. Retrieved June 19, 2010, from http://ce.sharif.ir/courses/86 /1/ce428/resources/root/ebanking%20service% 20quality/ 2.pdf

11. Floh, A. and Treiblmaier, H. (2006). What keeps the e banking Customer Loyal? A Multi group Analysis of the Moderating Role of Consumer Characteristics on e loyalty in the Financial Service Industry. Journal of Electronic Commerce Research, 7(2). Accessed on 10 June 2010. Available at: http://www.csulb.edu/web/journals/jecr/issues /20062/paper4 .pdf

12. Goldfinger, C. and Perrin, J.C. (2001). E Finance and Small and Medium Size Enterprises (SMEs) in Developing and Transition Economies. UNCTAD Expert Meeting “Improving Competitiveness of SMEs in Developing Countries: Role of Finance Including E Finance to Enhance Enterprise Development”, Palais des Nations, Geneva, October 22 24, 2001. Retrieved August 25, 2010, from http://www.unctad.org/en/docs/posdtem48.en.p df

13. Goode, WJ. And PK. Hatt (1952). Methods in social research. McGraw Hill.

14. Hertzum, Morten., Jørgensen, Niels. and Nørgaard, Mie. (2004). Usable Security and E Banking: Ease of Use vis vis Security. Australasian Journal of Information Systems, 11, special issue (2004): 52 65. Retrieved June 10, 2010, from http://dl.acs.org.au/index. php /ajis/article/view/124/103

15. Jahangir, N. and Begum, N. (2008). The Role of Perceived Usefulness, Perceived Ease of Use, Security and Privacy, and Customer Attitude to Engender Customer Adaptation in the Context of Electronic Banking. African Journal of Business Management, 2 (1): 32 40. Retrieved October 22, 2010, from http://www.academicjournals.org/AJBM

16. Mashadi, M.M. Tofighi, M. Nasserzadeh, M.R. and Mashadi, M.M. (2007). Determinants of E Banking Adoption: The Case of E Banking Services in Tehran. IADIS International Conference e Society 2007: 320 324. Retrieed October 23, 2010, from http://www.iadis. net /dl/final_uploads/200703C042.pdf

17. Padachi, K. Rojid, S. and Seetanah, B. (2007). Analyzing the Factors that Influence the Adoption of Internet Banking in Mauritius. Proceedings of the 2007 Computer Science and IT Education Conference: 559 574. Retrieved June 10, 2010, from http://csited.org /2007 /72PadaCSITEd.pdf

18. Ramayah, T. Jantan, M. Noor, M.N.M. and Ling, K.P. (2003). Receptiveness of Internet Banking by Malaysian Consumers: The Case of Penang. Asian Academy of Management Journal, 8 (2): –29. Retrieved July 13, 2011 from http://web.usm.my/aamj/8.2.2003 /AAMJ%208 1.pdf

19. Sekaran, U. (1999). Research Methods for Business: A Skill building Approach. 3rd ed. John Wiley and Sons.

20. Shih, Ya Yueh (2007). The Study of Customer Attitude toward Internet Banking Based on the Theory of Planned Behavior. This research was supported in part by the National Science Council of the Republic of China under the grant NSC 94 2416 159 004 and NSC 95 2416 216 009. Retrieved June 9, 2010, from http://ibacnet.org/bai2007/ proceedings /Papers/2007bai7536.pdf

21. Singh, S. Chhatwal, S.S. Yahyabhoy, T.M. and Heng, Y.C. (2002). Dynamics of Innovation in Banking. ECIS 2002, June 6–8, Gda?sk, Poland: 1527 1537.

22. Suh, B. and Han, I. (2002). Effect of Trust on Customer Acceptance of Internet Banking. Electronic Commerce Research and Applications, volume 1: 247–263. Retrieved March 27, 2011, from http://business.kaist.ac.kr/re_center/fulltext/200 2/2002 051.pdf

23. Tat, H.H. Nor, K.M. Yang, E.T. Hney, K.J. Ming, L.Y. and Yong, T.L. (2008). Predictors of Intention to Continue Using Internet Banking Services: An Empirical Study of Current Users. International Journal of Business and Information, 3 (2): 233 244.

24. Wahab, S. Noor, N.A.M. and Ali, J. (2009).Technology Trust and E Banking Adoption: The Mediating Effect of Customer Relationship Management Performance. The Asian Journal of Technology Management, 2 (2): 1 10. Retrieved September 18, 2011, from

25. Yang, J. and Ahmed, K.T. (2009). Recent Trends and Developments in E banking in an Underdeveloped Nation – An Empirical Study. International Journal of Electronic Finance, 3 (2): 115 132. Retrieved December 13, 2010, from http://hercules.gcsu.edu / ~jyang /Publica

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License