IJCRR - 4(4), February, 2012

Pages: 81-91

Print Article

Download XML Download PDF

FOREIGN DIRECT INVESTMENT AND RETAIL SECTOR IN INDIA: STRATEGIC ISSUES AND ITS IMPLICATIONS

Author: Anil Kumar B.Kote, P.M.Honnakeri

Category: General Sciences

Abstract:Indian retail industry is one of the sunrise sectors with huge growth potential. According to the Investment Commission of India, the retail sector is expected to grow almost three times its current levels to $660 billion by 2015. However, in spite of the recent developments in retailing and its immense contribution to the economy, retailing continues to be the least evolved industries and the growth of organized retailing in India has been muchslowerascompared to rest of the world.

Undoubtedly, this dismal situation of the retail sector, despite the ongoing wave of incessant liberalization and globalization, stems from the absence of an FDI encouraging policy in the Indian retail sector. In this context, the present paper attempts to analyse the strategic issues concerning the influx of foreign direct investment in the Indian retail industry. Moreover, with the latest move of the government to allow FDI in the multi brand and retailing sector, the paper analyzes the reason why foreign retailers are interested in India, the strategies they are adopting to enter India and their prospects in India. The Findings of the study point out that FDI in retail would undoubtedly enable India Inc to integrate its economy with that of the global economy. Thus, as a matter of fact FDI in the Buzzing Indian retail sector should not just be freely allowed but should be significantly encouraged.

Keywords: Retail sector, Globalization, Liberalization, foreign direct investment, Strategic issues and Implications.

Full Text:

INTRODUCTION

The Indian retail industry is the fifth largest in the world. Comprising of organized and unorganized sectors, retail industry is one of the fastest growing industries in India, especially over the last few years. With growing market demand, the industry is expected to grow at a pace of 25-30% annually. The Indian retail industry is expected to grow from Rs. 35,000crore in 2004-05 to Rs. 109,000 crore by the year 2010. The Indian retail industry is the most promising emerging market for investment. In 2007, the retail trade in India had a share of 8-10% in the GDP (Gross Domestic Product) of the country. In 2009, it rose to 12%. It is also expected to reach 22% by 2010(Kearney, A.T).According to the Investment Commission of India, the retail sector is expected to grow almost three times its current levels to $660 billion by 2015. It is expected that India will be among the top 5 retail markets then. The organized sector is expected to grow to $100 bn and account for 12-15% of retail sales by 2015(Singhal 1999). However, in late 1990's the retail sector has witnessed a level of transformation. Though initially, the retail industry in India was mostly unorganized, however with the change of tastes and preferences of the consumers, the industry is getting more popular these days and getting organized as well. According to a report by Northbride Capita, the India retail industry is expected to grow to US$ 700 billion by 2010. By the same time, the organized sector will be 20% of the total market share. India being a signatory to World Trade Organization‘s General Agreement on Trade in Services, which include wholesale and retailing services, had to open up the retail trade sector to foreign investment. There were initial reservations towards opening up of retail sector arising from fear of job losses, procurement from international market, competition and loss of entrepreneurial.

Opportunities. However, the government in a series of moves has opened up the retail sector slowly to Foreign Direct Investment (?FDI?). In 1997, FDI in cash and carry (wholesale) with 100 percent ownership was allowed under the Government approval route. It was brought under the automatic route in 2006. 51 percent investment in a single brand retail outlet was also permitted in 2006. FDI in Multi-Brand retailing is prohibited in India. Despite all the advantages that come along foreign investment in any sector of the economy, it is to be noted that FDI in India is not liberally allowed in all sectors including the retail sector, where FDI is either absolutely forbidden on the grounds of national interest, or, other sectors where the existing and notified sectoral policy does not permit FDI beyond aceiling.In this context, the present paper attempts to analyze the strategic issues concerning the influx of foreign direct investment in the Indian retail industry. The entire discussion is spread across Seven sections, the first being the introduction. Section II Gives the brief explanation to Growth potential for organized retail in India. Section III deals with the FDI Policy in India with regarding to Retailing Sector. Section IV highlights the strategic issues concerning the Indian retail sector; section V focuses on the strategic implications of FDI in the retail sector in India; while section VI assesses the role of FDI in boosting the organized retail sector in India. Section VII concludes the discussion and also puts forth some recommendations for exploiting the potential of the Indian retail sector through the positives of foreign direct investment.

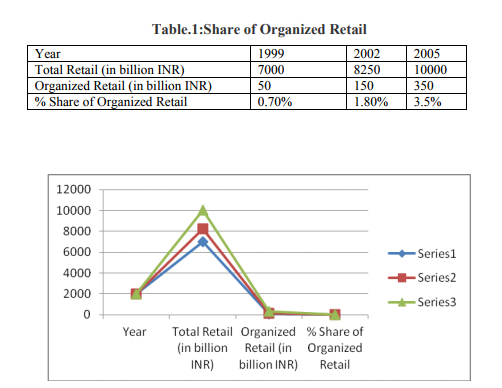

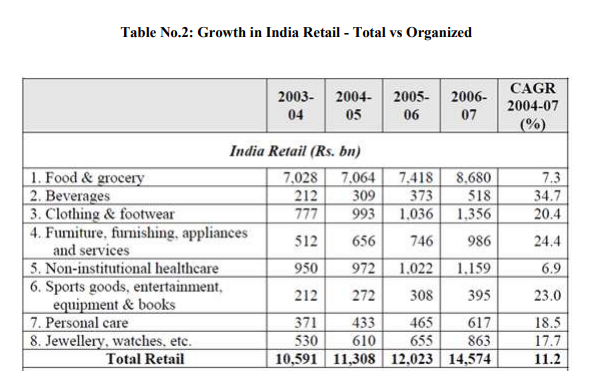

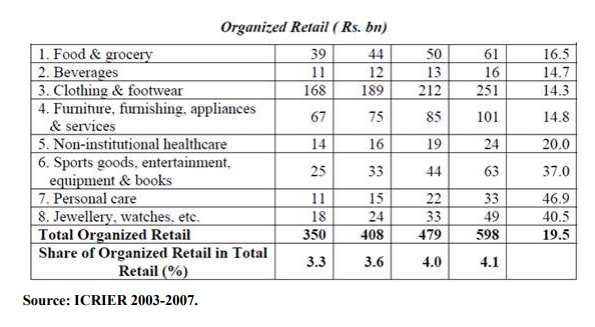

GROWTH OF THE POTENTIAL FOR ORGANIZED RETAIL IN INDIA

The retail business in the country is estimated to grow at the rate of 13% per annum to USD 590 billion in 2011-12 from USD 322 billion in 2006-07, according to a study by the Indian Council for Research on International Economic Relations (ICRIER). Additionally, the unorganized retail sector is expected to grow at about 10% per annum to USD 496 billion in 2011-12 from USD 309 billion 2006- 07. FDI in Multi-Brand retailing is prohibited in India. FDI in Single-Brand Retailing was, however, permitted in 2006, to the extent of 51%. Between April, 2006 and March, 2010 FDI inflow of USD 194.69 million was received, comprising 0.21% of the total FDI inflows during the period, under the category of single brand retailing.

Organized vs. Unorganized Retail

Organized retail makes for 75-80% of total retail in the developed countries, whereas the unorganized retail enjoys the dominating share in the developing countries. In the past few years developing countries have witnessed the opening and spreading of the modern retail outlets like hypermarkets, superstores, supermarkets, discount and convenience stores etc, which have a wide presence in the developed world. However, the unorganized retail outlets continue to dominate the overall retail scene in the developing countries. This in turn implies that the wholesalers and distributors who carry products from industrial suppliers and agricultural producers to these markets remain a critical part of the supply chain.

Rationale for FDI in retail trading

It is believed that foreign direct investment (FDI) can prove to be a powerful catalyst which can spur competition in the retail industry. This in turn will lead to supply chain improvement, development of skill and manpower, betterment in the agricultural segment as well as improved efficiencies in small and medium scale industries. Increasing FDI in the retail segment is also believed to help expand the market size, which in turn will help enhanced productivity. As a result the government also stands to gain by way of increased GDP, tax income and employment generation. With the consistently growing demand pressure, the unorganized retail segment will have to make way for the organized markets. In addition, the unorganized segment will fall short of addressing the growing demand for retail given the relatively weak financial state of unorganized retailers as well as the space constraints which restrict their expansion plans. Impact on Consumers It is believed that the overall consumer spending has witnessed an increase backed by the entry of the organized retail. Even though unorganized retail markets come with their set of benefits which include consumer goodwill, credit sales, bargain potential, ability to sell loose items, convenient timings, and home delivery, the consumers most certainly stand to gain from the expansion in organized retail on multiple counts. In addition, proximity remains a major comparative advantage for the unorganized outlets. However, it has been witnessed that the organized retail outlets have proved to provide better savings to the less well-off consumers other than providing saving to all the income groups in general.

THE FDI POLICY IN INDIA WITH REGARDING TO RETAILING SECTOR.

Definition of Retail In 2004, The High Court of Delhi defined the term ?retail‘ as a sale for final consumption in contrast to a sale for further sale or processing (i.e. wholesale). A sale to the ultimate consumer. Thus, retailing can be said to be the interface between the producer and the individual consumer buying for personal consumption. This excludes direct interface between the manufacturer and institutional buyers such as the government and other bulk customersRetailing is the last link that connects the individual consumer with the manufacturing and distribution chain. A retailer is involved in the act of selling goods to the individual consumer at a margin of profit.

FDI Policy in India

FDI as defined in Dictionary of Economics (Graham Bannock et.al) is investment in a foreign country through the acquisition of a local company or the establishment there of an operation on a new (Greenfield) site. To put in simple words, FDI refers to capital inflows from abroad that is invested in or to enhance the production capacity of the economy. Foreign Investment in India is governed by the FDI policy announced by the Government of India and the provision of the Foreign Exchange Management Act (FEMA) 1999. The Reserve Bank of India (?RBI‘) in this regard had issued a notification, which contains the Foreign Exchange Management (Transfer or issue of security by a person resident outside India) Regulations, 2000. This notification has been amended from time to time. The Ministry of Commerce and Industry, Government of India is the nodal agency for motoring and reviewing the FDI policy on continued basis and changes in sectoral policy/ sectoral equity cap. The FDI policy is notified through Press Notes by the Secretariat for Industrial Assistance (SIA), Department of Industrial Policy and Promotion (DIPP).The foreign investors are free to invest in India, except few sectors/activities, where prior approval from the RBI or Foreign Investment Promotion Board (?FIPB‘) would be required.

FDI Policy with Regard to Retailing in India

It will be prudent to look into Press Note 4 of 2006 issued by DIPP and consolidated FDI Policy issued in October 2010. Which provide the sector specific guidelines for FDI with regard to the conduct of trading activities. a) FDI up to 100% for cash and carry wholesale trading and export trading allowed under the automatic route. b) FDI up to 51 % with prior Government approval (i.e. FIPB) for retail trade of ?Single Brand‘ products, subject to Press Note 3 (2006 Series) c) FDI is not permitted in Multi Brand Retailing in India.

STRATEGIC ISSUES CONCERNING RETAIL SECTOR IN INDIA

Retailing is the largest private industry in India and second largest employer after agriculture. The sector contributes to around 10 percent of GDP. With over 12 million retail outlets, India has the highest retail outlets density in the world. This sector witnessed significant development in the past 10 years from small unorganized family owned retail formats to organized retailing. Liberalization of the economy, rise in per capita income and growing consumerism has encouraged large business and venture capitalist in investing in retail infrastructure. The importance of retail sector in India can be judged from following facts (a)Retail sector is the largest contributor to the Indian GDP (b) The retail sector provides 15%employment (c) India has world largest retail network with 12 million outlets (d) Total market size of retailing in India is U.S $ 180 billion (e) Current share of organized retailing isJust 2% which comes around to $3.6 trillion (f) organized retail sector is growing @ 28% per Annum. The Indian retail sector is very different from that of the developed countries. In the developed countries, products and services normally reach consumers from the manufacturer/producers through two different channels: (a) via independent retailers (?vertical separation‘) and (b) directly from the producer (?vertical integration‘). In the latter case, the producers establish their own chains of retail outlets, or develop franchises. On the other hand, Indian retail industry is divided into organized and unorganized sectors.Organised retailing refers to trading activities undertaken by licensed retailers, that is, those who are registered for sales tax, income tax, etc. These include the corporate-backed Supermarkets and retail chains, and also the privately owned giant retail businesses. Unorganized retailing, on the other hand, refers to the traditional formats of low-cost retailing, for example, the local kirana shops, owner manned general stores, paan/ beedi shops, convenience stores, hand cart and pavement vendors, etc. Unorganized retailing is by far the prevalent form of trade in India – constituting 98% of total trade, while organisedtrade accounts only for the remaining 2% – and this is projected to increase to 15-20 per cent by 2010 (Singhal 2009). Nonetheless the organized sector is expected to grow faster than GDP growth in next few years driven by favorable demographic patterns, changing lifestyles, and strong income growth. Liberalization of the Indian economy, increase in spending per capita income and the advent of dual income families‘ also help in the growth of retail sector. Moreover, consumer preference for shopping in new environs, availability of quality real estate and mall management practices and a shift in consumer demand to foreign brands like McDonalds, Sony, Panasonic, etc. also contributes to the spiral of growth in this sector. Furthermore, the Internet revolution is making the Indian consumer more accessible to the growing influences of domestic and foreign retail chains. Reach of satellite T.V. channels is helping in creating awareness about global products for local markets. About 47% of India's population is under the age of 20; and this will increase to 55% by 2015. This young population, which is technology-savvy, watch more than 50 TV satellite channels, and display the highest propensity to spend, will immensely contribute to the growth of the retail sector in the country. Moreover, the retail sector also acts as an important employment absorber for the present social system. Thus, when a factory shuts down rendering workers jobless; or peasants find themselves idle during part of the year or get evicted from their land; or the stagnant manufacturing sector fails to absorb the fresh entrants into the job market, the retail sector absorbs them all.

STRATEGIC IMPLICATIONS OF FDI IN RETAIL

In spite of the recent developments in retailing and its immense contribution to the economy, it still continues to be the least evolved industries and the growth of organized retailing in India has been much slower as compared to rest of the world. Over a period of 10 years, the share of organized retailing in total retailing has grown from 10 per cent to 40 percent in Brazil and 20 percent in China, while in India it is only 2 per cent (between 1995-2005). One important reason for this is that retailing is one of the few sectors where foreign direct investment is not allowed. Within the country, there have been protests by trading associations and other stakeholders against allowing FDI in retailing. On the other hand, the growing market has attracted foreign investors and India has been portrayed as an important investment destination for the global retail chains (http://www.articlesbase.com).The need for larger FDI is because India is at a stage where it needs US investments, technology, and management policies to sustain and enhance its economic growth. In 2006, Foreign Direct Investment (FDI) in India amounted to US$37 billion, out of which only $5billion was from the US. This was not a very encouraging figure in view of the goal of increasing the GDP by 34-36%. India still requires an FDI component equal to 4% of the GDP. The US needs to invest more in various sectors of the Indian economy. As such, India is rated as the 2nd best economy to invest in, after China. India is looking forward to a high growth rate of almost 16% – double that of the current 8%. Hence, there is a distinct need for larger FDI. There are other necessities which a larger FDI will cater to viz., employment generation, income generation, technology transfer, and economic stability. Hence, the need for larger FDI is a pressing situation these days in India. Foreign countries are well aware of This and many of them are taking extra initiative to invest in the Indian economy. retail sector both at the domestic and as well as at the international front and it seems that the government is giving the matter a very pensive and careful consideration. Some of the factors that have contributed to this trend are the evident profits in the ever growing but conserved Indian retails sector, reduction in tariff, cheaper real time communications, and cheaper transport. The main reasons for such an unequivocal demand stems from the realization that (i) while the retail sector requires heavy investment for expansion, there is hardly any local capital left in the capital markets as a consequence of global financial meltdown, and (ii) efficient management of multi-brand, multiproduct, multi location retail, especially in the area of back-end operations, require heavy dose of technology, which over the years has been developed and perfected by foreign players.

ASSES THE ROLE OF FDI IN BOOSTING THE ORGANIZED RETAIL SECTOR IN INDIA

Economic reforms taken by Indian government in 1991 makes the country as one of the prominent performer of global economies by placing the country as the 4th largest and the2nd fastest growing economy in the world. India also ranks as the 11th largest economy in terms of industrial output and has the 3rd largest pool of scientific and technical manpower. Continued economic liberalization since 1991 and its overall direction remained the same over the years irrespective of the ruling party moved the economy towards a market – based system from a closed economy characterized by extensive regulation, protectionism, public ownership which leads to pervasive corruption and slow growth from 1950s until 1990s.In fact, India‘s economy has been growing at a rate of more than9% for three running years and has seen a decade of 7 plus per cent growth. The exports in 2008 were$175.7 bn and imports were $287.5 bn. India‘s export has been consistently rising, covering 81.3% of its imports in 2008, up from 66.2% in 1990-91. Since independence, India‘s BOP on its current account has been negative. Since 1996-97, its overall BOP has-been positive, largely on account of increased FDI and deposits from Non – Resident Indians (NRIs), and commercial borrowings. The fiscal deficit has come down from 4.5per cent in 2003-04 to 2.7 per cent in 2007-08 and revenue deficit from 3.6 per cent to 1.1per cent in 2007- 08.As a result, India‘s foreign exchange reserves shot up 55 per cent in 2007-08 to close at US $309.16 billion – an increase of nearly US $110 billion from US $199.18 billion at the end of 2006-07. Domestic saving ratio to GDP shot up from 29.8% in 2004-05 to37.7% in 2007-08. For the first time India‘s GDP crossed one trillion dollars mark in2007. As a consequence of policy measures (taken way back in 1991) FDI in India has increased manifold since 1991 irrespective of the ruling party over the years, as there is a growing consensus and commitments among political parties to follow liberal foreign investment policy that invite steady flow of FDI in India so that sustained economic growth can be achieved. Further, in order to study the impact of economic reforms and FDI policy on the magnitude of FDI inflows, quantitative information is needed on broad dimensions of FDI and its distribution across sectors and regions. Thus, FDI in retailing is favored on a number of grounds. The global retailers have advanced management know how in merchandising and inventory management and have adopted new technologies which can significantly improve productivity and efficiency in retailing. The entry of large low-cost retailers and adoption of integrated supply chain management by them is likely to lower down the prices. Also FDI in retailing can easily assure the quality of product, better shopping experience and customer services. They promote the linkage of local suppliers, farmers and manufacturers, no doubt only those who can meet the quality and safety standards, to global market and this will ensure a reliable and profitable market to these local players. As multinational players are spreading their operation, regional players are also developing their supply chain differentiating their strategies and improving their operations to counter the size of international players. This all will encourage the investment and employment in supply chain management. Moreover, joint ventures would ease capital constraints of existing organized retailers and FDI would lead to development of different retail formats and modernization of the sector. Therefore, FDI in retail would undoubtedly enable India Inc to integrate its economy with that of the global economy. FDI will help to overcome both – the lack of experience in organized retailing as well as lack of trained manpower. FDI in retail would reduce cost of intermediation and entail setting up of integrated supply chains that would minimize wastage, give producers a better price and benefit both producers and consumers. From the stand point of consumers, organized retailing would help reduce the problem of adulteration, short weighing and substandard goods (Bhukta 2009). FDI will not just provide access to larger financial resources for investment in the retail sector but simultaneously will rationally allow larger supermarkets, which tend to become regional and national chains – (i) to negotiate prices more aggressively with manufacturers of consumer goods and thus pass on the benefit to consumers; and (ii) to lay down better and tighter quality standards and ensure that manufacturers adhere to them. Moreover, consumer goods manufacturers generally prefer supermarkets since they not just offer a wide range of their products and services, so the consumer can enjoy single-point shopping, but simultaneously they by their attractive presentation and tempting retailing strategies also account for an increasing share of consumer product sales. Also, the fact that a well-known chain of supermarkets procures its goods from a known manufacturer becomes as tamp of quality. Moreover, with the availability of free flow of finance in conjunction with advent of healthy inflow of FDI, the supermarkets will be in a better position than small retailers to make shopping a pleasant experience by making investments in much needed infrastructure facilities like parking lots, coffee shops, ATM machines, etc. It can thus be safely contended that with the possible advent of unrestrained FDI flows in retail market, the interests of the retailers constituting the unorganized retail sector will not be gravely undermined, since nobody can force a consumer to visit a mega shopping complex or a small retailer/ sabji mandi. Consumers will shop in accordance with their utmost convenience, where ever they get the lowest price, max variety, and a good consumer experience. Moreover, it is to be noted that the small retailers will still remain in good business owing to Economic growth and FDI are closely linked with international trade. Countries that are more open are more likely to attract FDI inflows in many ways: Foreign investor brings machines and equipment from outside the host country in order to reduce their cost of production. This can increase exports of the host country. Growth and trade are mutually dependent on one another. Trade is a complement to FDI, such that countries tending to be more open to trade attract higher levels of FDI.

CONCLUSIONS AND RECOMMENDATIONS

In recent times the consumer are showing much greater confidence and in a due response the retail players in the market are veering towards aggressive expansion plan. These developments are clearly signaling an affluent time for retail sector. As the organized retails pace in India continues to grow, it is likely to see a number of initiatives in the near future. Companies are likely to combine expansion with innovative measures as they look to ensure profitability in difficult times. Players need to increase their investments in retail ancillaries and retail logistics to ensure sustained benefits. As a survival strategy, moves are on to allow FDI in the multi-brand retailing sector and there is fresh flow of equity investment in this sector which will definitely give the Indian retail sector a much needed boost. The advantages of allowing unrestrained FDI in the retail sector

References:

1. www.Legalserviceindia.com

2. www.Manupatra.com

3. www.Scribd.com

4. www.cci.in

5. www.rbi.org.in

6. www.dipp.nic.in

7. www.legallyindia.com

8. ww.icsi.ed

9. www.retailguru.com.

10. Bhukta Gan, 2009, ?Optimizing Youth Employment Through FDI in Retail in India? ,GITAM Institute of Foreign Trade, India Business Insights International 2009, Foreign Direct Investment in the Indian Retail Sector, availableathttp://www.businessinsights.biz /Business%20Insights%20International/B usiness%20Updates/Foreign%20Direct%2 0Investment%20in%20the%20Indian%20 Retail%20Sector.htm, last visited 24th April, 2009.

11. http://business.mapsofindia.com/fipb/form s-foreign-capital-flowing.html, last visited 14th Oct.2010.

12. http://business.rediff.com

13. http://dipp.nic.in/manual/manual_0403.pd f., Manual on the FDI in India, May –

14. 2003, published by the Ministry of Commerce and Industry last visited 12th Oct.2010.

15. http://toostep.com/debate/fdi-in-fashionindustry, FDI in Fashion Industry, last visited 20th Sept. 2010

16. http://www.articlesbase.com/investingarticles/foreign-direct-investment-inretailingin-india-its-emergence-prospects- 1354932.html#ixzz0zaLkvDV3

17.http://www.articlesbase.com/publishingarticles/retail-industry-inindiachallengesopportunties-andstrategies-158550.html#ixzz0yj5aWch7

18. http://www.indiaretailbiz.com/blog/2009/0 7/02, India Retail Biz, Allowing FDI in retail will enlarge scope, bring fresh capital, and increase competition, say industry leaders,Welcoming Survey, available at last visited 26th April, 2009.

19. http://www.indiaretailbiz.com/blog/2009/0 7/02, Indian Retail Biz, Economic Survey recommends opening of retail to foreign investment (FDI); suggests making beginning with ?food‘ segment, last visited 12th Oct, 2010.

20. http://www.indiaretailbiz.com/blog/2009/0 7/02,Indian Retail Biz, Economic Survey recommends opening of retail to foreign investment (FDI); suggests making beginning with ?food‘ segment, , last visited 24th Sep., 2010.

21. http://www.rupe-india.org/43/retail.html Dey Dipankar , FDI in India‘s Retail Trade: Some Additional Issues, last visited 14th Oct 2010.

22. Kalathur S. 2009, Opportunity India: Retail Sector, available at http://www.valuenotes.com/VNTeam/vn_i nvestRetailSector_18oct06.asp?ArtCd=1 03512andCat=IandId=, last visited 25th Oct. 2010

23. Kearney, A.T, 8th Annual Global Retail Development Index (GRDI).

24. Knight Frank India 2010, 'India Organised Retail Market 2010', published in May 2010.

25. McKinsey and Company report 2008, 'The Great Indian Bazaar: Organised Retail Comes of Age in India'.

26. Mukherjee Arpita and Patel Nitisha, Report on FDI in Retail Sector: India, available at http://www.icrier.org/conference/2006/14j uly_05.html

27. Raghunandan D. 2010, ?Fdi in Organised Retail: A Lose-Lose Game‘ India Cuarrent Affairs, Economy, posted on 17-07-2010.

28. RNCOS 2008, 'Booming Retail Sector in India', published in June 2008.

29. Roye S. D. 2009, ?No to FDI in Retail‘, No to Wal-Mart‘, available at

30. http://indiafdiwatch.org/fileadmin/WARN storage/NoFDI.pdf, last visited 14th Oct 2010.

31. Singhal, Arvind, 2009, Indian Retail: The road ahead, Retail biz, available at www.etretailbiz.com, last visited 14th Oct.2010.

32. Singhal, Arvind, Technopak Projections, 1999, Changing Retail Landscape, www.ksa-technopak.com

33. The Economic Times 2009, article entitled ?House panel for ?no entry‘ to corporates in retail?, June 6, 2009

34. The Times of India 2009, article entitled ?House panel applies brake on FDI in retail?, June 6, 2009.

35. The Times of India 2009, article entitled ?IKEA drops investment plans in India worth $1bn, 11th June, 2009

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License